I realize I may seem like I'm being a pain in this particular government agency's backside, but the only way we can gauge housing's recovery is to gauge the foreclosure crisis, and the only way we can gauge the foreclosure crisis is to know if the government's 75 billion dollar bailout is working as hoped.

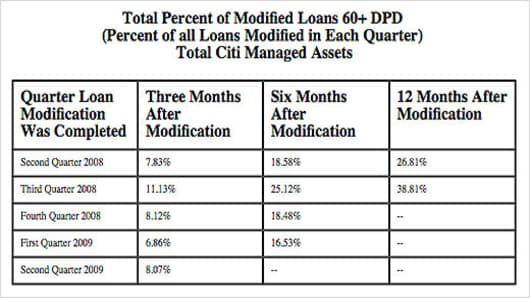

Getting back to the Citi report, redefault rates are still running high, even in the second quarter, which would have been when at least some of the bank's modifications fell under the HAMP program. In any case, in the first part of this year, banks supposedly got away from offering just repayment plans, which can often raise a monthly payment, to real modifications that either reduce principal or reduce mortgage interest rates. Redefaults now are likely less to do with a poor modification and more to do with unemployment and loss of home equity.

Kudos to Citi for releasing the data.

Questions? Comments? RealtyCheck@cnbc.com