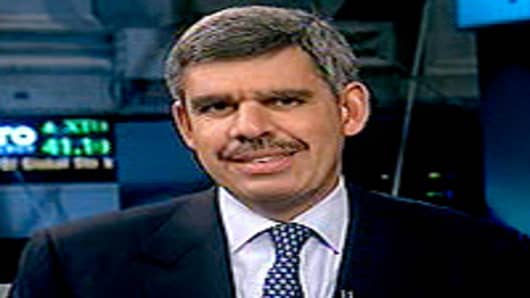

Debt problems in foreign countries are now also a problem for US investors, Pimco's Mohamed El-Erian told CNBC.

Before the credit crisis, US-based investors wouldn't have had to worry about sovereign balance sheet issues such as those prevalent in Greece and other European Union nations, El-Erian, Pimco's CO-CEO, said in an interview.

(see video below for full interview)

But with the interconnected issues in global finance and the bailouts that follow, what ails Greece also ails the US.

"The US is not Greece. The US has elements of Greece," El-Erian said when asked what US investors should do in response to the sovereign debt crises. "You recognize that the minute the sovereign is disrupted that has ripple effects through risk markets.

"You become more humble not about what should happen...it's really what's likely to happen, and what's likely to happen is muted growth, concern about public financing, a crowding out of the private sector and therefore we have to impose a risk premium on account of those factors."

The foreign debt issue feeds into Pimco's forecast of the "new normal" and its scenario of slower growth than what would be expected during a recovery. El-Erian said there is a 60 percent chance of "muted growth and dead dynamics" ahead.

As for the rescue of Greece in particular—the instability of its debt has roiled global markets and has stunted US stock indexes—he said the process will be complicated and unlikely to be resolved quickly.

He said policy makers face two challenges: Selling the financial restructuring to the public, where protests already have erupted over the fiscal belt-tightening ahead; and to come up with a plan with limited moral hazard of triggering more problems.

"They need to swallow their pride and bring in an outsider who can coordinate and oversee" the process, he said. "It's really difficult to coordinate these two things."