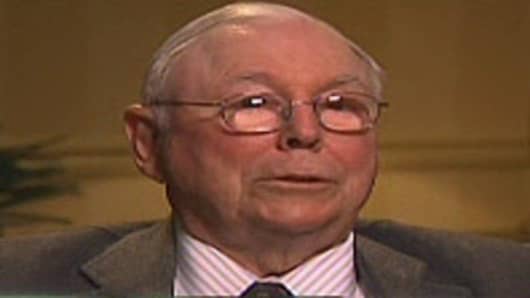

Warren Buffett and his longtime business partner Charlie Munger get along so well, in part, because they have very different, but complementary, temperaments.

Buffett oftens laughs and makes jokes when he speaks publicly. Munger is more likely to growl, and he makes no attempt to be diplomatic. Last May, he told our Becky Quick that the banks' "evil and folly" had "helped create a catastrophe for everyone."

Fortune Magazine's 2006 profile of Munger includes this apt description of how the two men interact on stage during the marathon Q&A session that highlights each year's Berkshire Hathaway shareholders meeting in Omaha:

Over the years the Buffett-and-Munger show has taken on a somewhat formulaic choreography. The two men sit center stage, facing a dark sea of shareholders. Questions are usually fielded first by Buffett, who will answer and then ramble a bit in his inimitable way - often with a one-liner or two mixed in - for five minutes or so.

At that point he will look over to his partner and inquire, "Charlie?" Then one of two things occurs: Munger will either lean in and make a pointed, pithy, often scathing comment (which sometimes elicits gasps or loud guffaws from the crowd). Or Munger will simply remark, "I have nothing to say." (Which, after a particularly long-winded Buffett digression, can be amusing as well.)

Usually Munger doesn't have all that much to say in public, but there are exceptions.

Today (Sunday) his "parable about how one nation came to financial ruin" is one of the most-read and most-emailed items on Slate, the daily web 'magazine' owned by the Washington Post.

Under the headline Basically, It's Over, Munger tells the story of "Basicland," a "large, unpopulated island" in the Pacific Ocean "rich in all nature's bounty except coal, oil and natural gas." It's discovered by Europeans in the early 1700s and repopulated as a new nation.

"Basicland" prospers with a "national ethos that sought to provide a sound currency, efficient trade, and ample loans for credit-worthy businesses while strongly discouraging loans to the incompetent or for ordinary daily purchases." The government provides only essential services, funded by a simple tax system. In short, a Charlie Munger paradise.