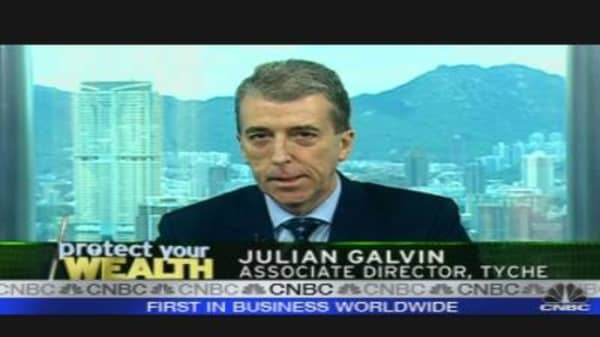

He advised clients to avoid the sovereign debt of Western countries like the U.S., Europe and the UK as those countries are currently in the second wave of the global financial crisis.

The problems in the West were never actually fixed, he said.

"All that actually happened was corporate debt got transferred from the books of companies across to the books of governments, which were already overburdened with debt."

However, growing fears that China may implement further tightening measures to prevent a bubble from forming, could take the wind out of Asia’s sails.

"There is certainly some pressure in the property market, in certain sectors of the property market. But I think the Chinese government is doing an excellent job of reining some of this in," Galvin said.

Due to that reason, Galvin told CNBC he remains upbeat on the long-term prospects for raw materials, as "the growth in China is not going to slow down… This is a five-10-20 year game plan and beyond that they're playing."

Comments? Questions? Send them in here.

Catch "Protect Your Wealth" on CNBC's Asia Pacific network every Tuesday on "CNBC's Cash Flow," Wednesday on "Asia Squawk Box" and Thursday on "Capital Connection."