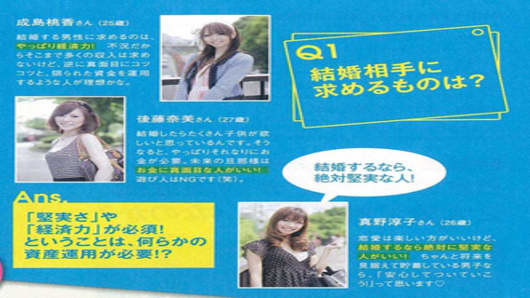

The Strategy Session—on Friday June 11, 2010—showed a Japanese advertisement that was given to us by a source.

According to the Japanese Ministry of Finance , that image was not "genuine," and provided us with this advertisement that a Japanese advertising agency, Dentsu , created on consignment for them.

To view the entire advertisement, click here.

On Friday the new Prime Minister of Japan, Naoto Kan, warned that the country must control its national debt or risk defaulting .

This comes after this week's interesting advertisement , placed in Japanese magazines by the Ministry of Finance, which attempts to use the power of suggestion to sell government bonds .

Why the push to sell these bonds? According to our sources, Japan is out of money, currently spending twice what it makes.

The essential point is that Japan's working-age population peaked last year, and as a result the country has to pay out more than it takes in, due to a secular population decline.

In addition, rating agencies have turned up the heat by threatening to cut Japan’s sovereign debt rating unless the government devises a plan to cut its debt. Standard & Poor's already cut its outlook for Japan because it lacked a plan back in January.

Japan’s central government expenses will be 96 trillion yen, but they are spending twice this amount; the country’s debt service alone is 20.2 trillion yen (50 percent revenues) and its social security cash expenditures at 24 trillion yen.

The bottom line: it is plausible that the world’s second largest economy is about to enter a real bond crisis and soon the Greek tragedy may very well take a back seat.

Related Links:

- Bank of Japan details $33 Billion Loan Programme

- Can Sex Sell Sovereign Debt?

- Japan Refocuses on Debt Problems

- Japan's Ruling Party To Pledge To Balance Core Budget

*Correction: This post was updated and the advertisement image was changed on Tuesday, June 15.

"The Strategy Session," hosted by David Faber and Gary Kaminsky, airs weekdays at Noon ET on CNBC.