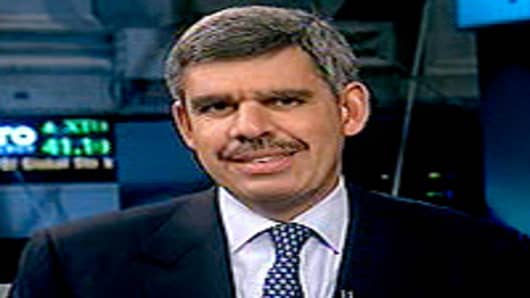

Despite all the anticipation over today's Federal Reserve meeting, there's little else the central bank can do now to help the economy recover, Pimco's co-CEO Mohamed El-Erian told CNBC.

Speaking just hours before a much-anticipated meeting of the Fed's Open Market Committee, El-Erian said the central bank can only do so much to foster growth and avoid deflation. The Fed has spent the past three years on a route of aggressive rate cuts and purchases of trillions in various securities but is running out of measures it can take.

El-Erian helps run the world's biggest bond fund with more than $1 trillion in assets under management.

"Fed policy is not enough. You need to do more than that to get off that road," he said.

Asked what needs to be done, he said, "First, selling a vision, a long-term vision as to what the policy response is to restore growth and employment. And second, to fill it out with proper structural policies."

The Tuesday Fed meeting is likely to end with the central bank assuring markets it will use "all viable instruments" to prop up the economy, El-Erian said.

However, it is less certain "the extent to which the Fed will push banks to lend and will push investors to take more risks."

He also expects the Fed to use the "unusually uncertain outlook" for the economy that Fed Chairman Ben Bernanke recently coinedto describe the times ahead. El-Erian cited three reasons for the uncertainty.

"First, it's very difficult to get consensus on the FOMC. Second, there's a realization that policy effectiveness is going down. You get less outcomes for the same unit of reaction. And third, it's the wrong thing to focus on," he said.

"The country is facing structural issues and it needs structural solutions," he added. "Just focusing on the Fed is like sending in a wide receiver to play quarterback. Yes, the wide receiver is a good athlete. But he's not a quarterback and we need to focus on structural issues."