Xilinx CEO Moshe Gavrielov appeared on the "Halftime Report" Thursday after having reported quarterly earnings results the day before.

Based in San Jose, Calif., the technology name is in the semiconductor industry.

Watch the video to see the full interview with Gavrielov.

---

CALL THE CLOSE

Steve Cortes, founder of Veracruz, is long the dollar.

"Buy the dips has worked for the last two months or so," noted Stuart Frankel's Steve Grasso. "I'm still sticking with that."

"Price action is scaring me here," countered Guy Adami, managing director of Drakon Capital. "I think you might want to take profits. Sell."

______________________________________________________

Got something to to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap. If you'd prefer to make a comment, but not have it published on our Web site, send those e-mails to fastmoney@cnbc.com.

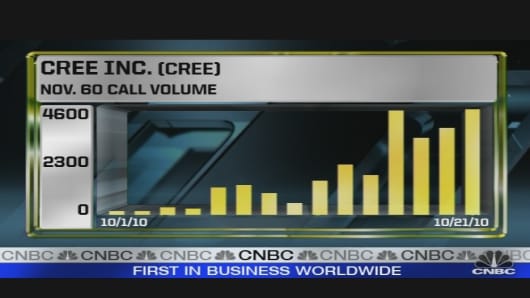

Trader disclosure: On Oct. 21, 2010, the following stocks and commodities mentioned or intended to be mentioned on CNBC’s Fast Money were owned by the Fast Money traders; Adami owns (AGU), (BTU), (NUE), (C), (GS), (INTC), (MSFT); Adami’s wife works at Merck; Cortes is short crude oil; Cortes is short gold; Cortes is short (BIDU); Cortes is short (RSX); Cortes is short the U.K. Pound; Cortes owns U.S. Treasuries; Cortes owns the S&P 500; Jon Najarian owns (AMZN) calls; Jon Najarian owns (CAT) calls; Jon Najarian owns (EBAY) calls; Jon Najarian owns (GS) calls; Jon Najarian owns (MCD) calls; Jon Najarian owns (NFLX) calls; Jon Najarian owns (SNDK) calls; Jon Najarian owns (CREE) call spreads; Jon Najarian owns (NTRI) call spreads; Grasso owns (ASTM), (BA), (BAC), (C), (CSCO), (JPM), (LPX), (MO), (MOT), (NDAQ), (PFE), (PRST)

For Steve Grasso:

Stuart Frankel & Co and it’s partners own (COG)

Stuart Frankel & Co and it’s partners own (CUBA)

Stuart Frankel & Co and it’s partners own (GERN)

Stuart Frankel & Co and it’s partners own (HPQ)

Stuart Frankel & Co and it’s partners own (HSPO)

Stuart Frankel & Co and it’s partners own (MERC)

Stuart Frankel & Co and it’s partners own (NWS.A)

Stuart Frankel & Co and it’s partners own (NYX)

Stuart Frankel & Co and it’s partners own (OPEN)

Stuart Frankel & Co and it’s partners own (PDE)

Stuart Frankel & Co and it’s partners own (PFE)

Stuart Frankel & Co and it’s partners own (PRST)

Stuart Frankel & Co and it’s partners own (RDC)

Stuart Frankel & Co and it’s partners own (TLM)

Stuart Frankel & Co and it’s partners own (XRX)

Stuart Frankel & Co and it’s partners own (SDS)

Stuart Frankel & Co and it’s partners are short (QQQQ)

For Tim Boyd

***No Disclosures***

For Jason Helfstein

Oppenheimer & Co. Inc. makes a market in (NFLX)

CNBC.com with wires.