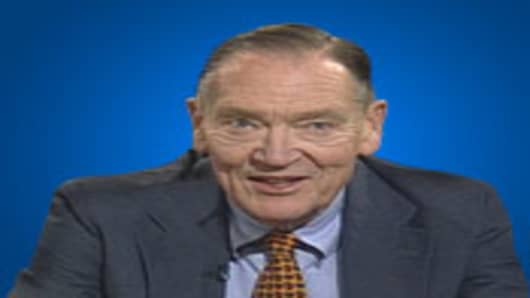

ETFs (exchange-traded funds) may be one of the greatest marketing tools of the 21st century, but, perhaps, not the best investing tool, founder and former CEO of Vanguard, John Bogle, told CNBC Thursday.

Bogle said among the pitfalls are that ETFs “turn over at a fantastic rate and they reflect the public appetite for performance chasing.”

When Vanguard tracked the returns on 175 ETFs recently, said Bogle, it found investors fell about six percent short per year of the actual index the ETFs were designed to track—adding up to a 30 percent gap over five years.

Bogle did say he's a fan of some ETFs, specifically total market ETFs that cover the S&P 500 Index . “There probably aren’t many investments that are better,” he added.

Bogle, of course, likes index funds, which are a large part of Vanguard's mutual fund business.