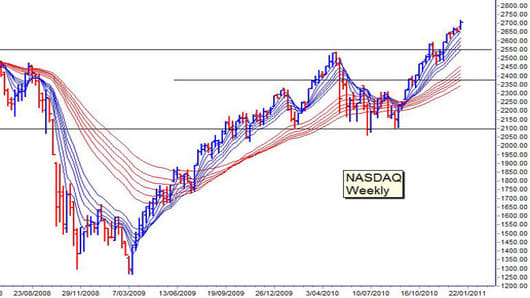

The Nasdaq has been the leading indicator of the U.S. equity markets since March 2009, when the economy began its recovery. The Nasdaq leads and the Dow follows. So it may be worth checking the Nasdaq chart for clues on where the Dow may be headed.

The current trend strength in the Nasdaq is stronger and more stable than the trend strength seen in the Dow. There are currently two targets for the Nasdaq. The first uses a calculation based on the historical support and resistance level near 2,370. The upper level of the new trading band is based on the 2010 May peak near 2,550. This is also an historical support and resistance level. These are not exact levels, but they are used to give a general idea of the target range for the Nasdaq trend. This trading band width is projected upwards and gives an initial target in the 2,740 area. The Nasdaq is currently near these levels.

The second target calculation uses a wider trading consolidation band. The upper level of this band uses the 2010 May peak near 2550. The lower edge of this wider trading band uses the historical support and resistance level near 2100. Again this is not an exact value so the calculation is used as a guide.

The width of this trading band area is projected upwards from the peak near 2550 and gives a longer term upside target near 2950. This is above the previous 2007 November peak for the Nasdaq. The 2,850 level provides a strong technical and psychological barrier and there is a higher probability of a trend pause in this area. The lower edge of this pause area is based on the 2,740 level. A market pause in this narrow area between 2,740 and 2,850 provides a foundation for a breakout above 285.

A retreat within this pause area sets up the conditions for a rebound and a continuation of the uptrend. It is a good entry point for investors who have missed the early part of this uptrend breakout.

The Nasdaq has an upside target near 2,950, although there may be a pause at around the 2,850-level before the momentum resumes.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders –www.guppytraders.com. He is a regular guest on CNBCAsia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe.

If you would like Daryl to chart a specific stock, commodity or currency, please write to us at ChartingAsia@cnbc.com. We welcome all questions, comments and requests.

CNBC assumes no responsibility for any losses, damages or liability whatsoever suffered or incurred by any person, resulting from or attributable to the use of the information published on this site. User is using this information at his/her sole risk.