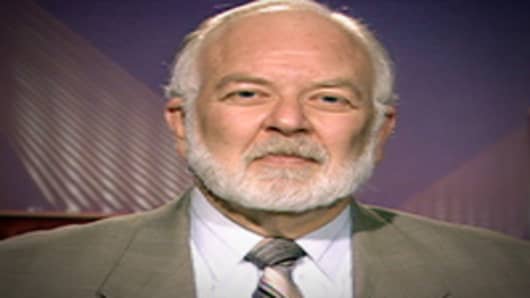

The banking industry is entering another "golden age," with so much cash on hand that earnings will grow 20 percent annually over the next few years, well-known banking analyst Dick Bove told CNBC.

"There's so much cash in some of the banks in the United States that they're actually selling at below their cash value per share," said Bove, of Rochdale Securities. "For example, Citigroup, Bank of America, Bank of New York, State Street, Northern Trust—they all sell at below their cash per share."

"What that means," he continued, "is that these companies now have tremendous amount of liquidity, which ultimately can be put to use to generate further earnings growth. And I think for the next two to three years, what you will see is that banks will actually increase their earnings at about a 20 percent rate per year, which will be far faster than what you're going to see from the industrial averages."

Bove dismissed the notion that banks' recent profitability was largely due to the Federal Reserve's easy credit policies, saying banks "don't need it."

"They've completely restructured their balance sheets," he said.

And with the Dodd-Frank financial overhaul now complete, "banks will be bringing out new products which no one is going to like but which are going to be very profitable for the banking industry."

Bove dismissed worries about the foreclosure mess, in which banks are facing huge potential liabilities from sloppy and sometimes negligent processing of mortgages.

"They're legal problems, not financial problems," he said. "The banking industry is almost like the tobacco industry or the asbestos industry. And by that I mean, for the next five to seven years, they're going to have to allocate a big chunk of revenue simply to paying legal bills."

The so-called put back issue, in which banks may have to compensate investors who bought mortgage-backed securities, also won't be a big burden on earnings, he said. Most banks have already written off the majority of their bad mortgages, he added.

"Bad loans are coming down in the industry," he explained. "Chargeoffs are coming down...Essentially we're talking about ancient history."

A persistent fan of Citigroup, Bove noted that he still "loves" the stock, particularly following its recent cross over the $5 a share barrier.

He also calledBank of New York "very exciting," for its high levels of cash.

Wall Street titan Goldman Sachs is an obvious favorite, Bove said, as the banking sector enters what he calls one of the "most exciting mergers and acquisition periods in history of the business." Yet in this time, investors shouldn't forget "little companies" like Lazard and Evercore also poised to get a piece of increased M&A action.

"That's all they do, so that their earnings should be explosive," Bove said.