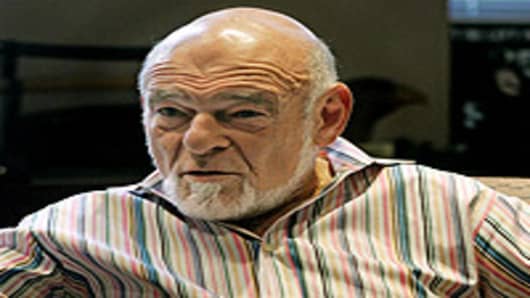

The US standard of living could drop 25 percent if the dollar loses its standing as the world's reserve currency, investor Sam Zell told CNBC.

"My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country," the chairman of the Tribune Company as well as Equity Group Investments said in a live interview. "I'm hoping against hope that ain't gonna happen, but you're already seeing things in the markets that are suggesting that confidence in the dollar is waning."

As Zell spoke, the value of the greenback took yet another hit as European Central Bank President Jean-Claude Trichet indicated that an interest rate hike was possible next month if euro zone inflation continues to heat up.

The dollar reached a four-month low against a basket of foreign currencies as well as the euro. Trichet's remarks came a day after Federal Reserve Chairman Ben Bernanke addressed Congress and gave no indication the US central bank is preparing to exit its zero-interest-rate policy in place since the financial crisis began.

At the same time, the dollar was suffering under the weight of huge debt and budget deficits in Washington that threatened the currency's standing among its global trading partners.

Should trends not change, Zell said, the effects could be disastrous.

"I think you could see a 25 percent reduction in the standard of living in this country if the US dollar was no longer the world's reserve currency," he said. "That's how valuable it is."

Zell's comments echoed those of two other influential business leaders. On Wednesday, billionaire Warren Buffett told CNBC that the dollar will become "less important" over time as America's "dominance" of the world's economic system "diminishes."

And in CNBC interview on Thursday, Ray Dalio, founder & CIO of the hedge fund Bridgewater Associates, said the dollar's dominance in the world will diminish as emerging markets raise interest rates to slow their economies over the next 18 months.

"It's inevitable that the dollar's role as the world's currency will diminish from the dominant world currency to one of a few," Dalio said.

The dollar's reserve currency status offers a number of advantages, primarily in terms of purchasing power in the global marketplace. While there has been some saber-rattling about introducing other currencies into the mix, no move has been made yet.

"That's an awesome benefit that no other country in the world has," Zell said.

He blamed "financial profligacy" in Washington for the loss of faith in the greenback, citing specifically the "(Rep. Nancy) Pelosi stimulus that was nothing more than feeding a bunch of people who shouldn't have jobs in the first place."

Financial pressures also should be reflected in the bond markets, which he said will be imperiled by inflation even though debt trading has resisted that pressure so far.

"I don't know who's buying 30-year fixed debt. I don't understand TIPS (Treasury Inflation Protected Securities) that are projecting 30 years of benign inflation," he said. "This is the tooth fairy coming back in spades."

Misleading government data is fooling investors into believing there is no inflation, said Zell, who pointed out that 42 percent of the Consumer Price Index the government uses to gauge inflation is housing, where costs have been flatlining or falling. In the meantime, energy costs are up 9 percent and food is up 12 percent.

"If you adjusted the CPI to reality I think you'd be looking at 5, 6, 7 percent inflation today," he said.

To fix what ails America, Zell prescribed more open immigration policies—"We're giving PhDs but not green cards. It's just preposterous"—to attract brighter minds and to emphasize American exceptionalism. He also faulted the Obama administration for "killing aspiration."

"Our historical position has in fact put us in a position where we can attract anybody from anywhere in the world and we've just got to recognize that and act accordingly," he said. "The best days of America are ahead of America as long as we continue to be America."