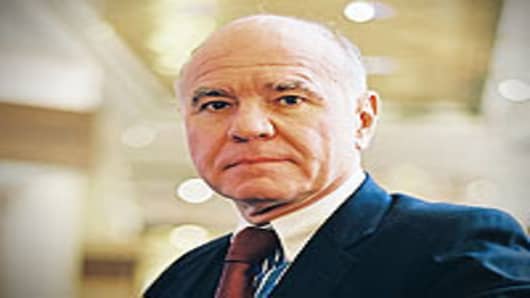

Famed investor Marc Faber, Editor and Publisher of The Gloom, Boom & Doom Report said investors "should be their own central banks and gradually accumulate gold reserves as a currency", rather than speculating in gold.

According to Faber once the Federal Reserve's quantitative easing ends in June, the central bank will come under pressure to announce another round of easing, or QE3. While he acknowledged the greenback may see a temporary rally, he said long-term the dollarwould to continue to decline. Click here for more.

"The value of the U.S. dollar will be precisely its intrinsic value — namely zero, precisely zero," said Faber. That in turn would boost demand for gold and silver.

Spot gold hit a record high of $1,4880.50 on Monday, while silver rose to a 31-year high of $43.34 as concerns about rising inflation and the euro zone's debt problems boosted safe haven demand.

Another factor that would boost gold prices were negative real interest rates in emerging economies. He said interest rate hikes in countries such as India and China would not keep up with the rising cost of living and that would make assets such as gold and property attractive.

Faber recommended holding physical bullion over other gold assets such as ETFs or gold mining companies. However, he advised against holding gold assets in the U.S. because of the risk of "expropriation" of gold assets by U.S. authorities. Click here for full interview.

Faber also said he expects property prices in places such as Singapore to continue rising given negative real interest rates in that country. And he said the most important thing investors needed to do at a time like this was to diversify.

"(Investors) need to own some real estate, they need to own some farmland, they need to own some equities, some cash and some precious metals," Faber added.