The outcome of Wednesday's first ever Federal Open Market Committee (FOMC) press conference is likely to set the tone for the week's and potentially the quarter's trade, with the point at which investors can confirm the end or extension of quantitative easing by the US central bank fast approaching.

For months, analysts and fund managers I have spoken to have speculated on the prospects for the stock market once it becomes clear whether the second round of quantitative easing — or creating money — is ending or being extended.

On one side of the debate are those who feel once the punch bowl of QE is taken away the success the Fed has had in restoring confidence via the 'wealth effect' will evaporate taking the Teflon market with it.

On the other side are those who argue that the end of QE2 is a sign of confidence that the economy is now on a sustainable pathand able to focus on the improving fundamentals that are driving the global growth and corporate profits.

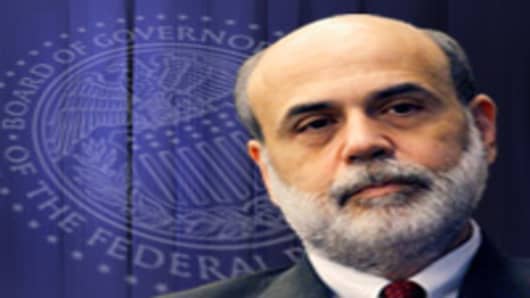

Whatever side of the argument you believe, crunch time is fast approaching. Because Federal Reserve Chairman Ben Bernanke will have to answer the following question: will QE2 come to an end as expected at the end of the second quarter?

His possible answers range from a straight yes, to a maybe and a no; how he manages the language around one of three possible answers could lead to one of the most interesting trading days in recent history.

Bernanke will be pushed for his view on rising inflation, the divergence of his view with that of Jean-Claude Trichet and S&P's decision to downgrade its outlook for US debt.

All big questions for sure, but all a lot easier to answer than the QE2 conundrum for the Fed chief who can say: no change on inflation expectations, the euro zone is facing different economic forces and Congress needs to find a deal on soaring spending without causing big moves for asset prices.

Can't Avoid an Answer

What he cannot do with just over two months until its scheduled conclusion is fudge the QE2 question.

“In all likelihoods there will be some clues on the end of QE,” said Gary Schlossberg, the chief economist at Wells Fargo Commercial in an interview with CNBC on Tuesday.

Investors are nervous, in Schlossberg's view, as the potential change in policy is so big. “This is a sea change following years of very accommodating policy”

So governor Bernanke, will the FOMC end QE2 on schedule?

The first possible answer is "yes we will." This answer could really spook investors, if when pushed Bernanke confirms that following vigorous debate with the more hawkish members of the FOMC he has decided that extending beyond the end of June could drive up inflationary pressures.

Now given the Fed has maintained it is not that worried by signs of inflationary pressures such an answer is unlikely and if Bernanke is to signal an end to QE2 in June it is more likely he will indicate the move is a sign of confidence that the US economy can now stand on its own two feet.

If he can sell that message then bears have been sadly mistaken and the so-called ‘Teflon" market could escape a QE2 correction.

“The message is likely to be that the Fed will complete QE2 in full, but is in no rush to tighten monetary policy, particularly fiscal policy is being reined in,” said Paul Ashworth, the chief US economist at Capital economics in a research note.

The second possible answer is maybe. This answer would go as follows: we, the FOMC, plan to end QE2 on schedule but will be reviewing the data over the coming weeks and months to see if a new program is needed.

This answer leaves investors, and the journalists asking them, scratching their heads and asking themselves what Bernanke's first-ever press conference actually changed.

As Jean-Claude Trichet would probably say when he calls Bernanke straight after, the press conference would be a win; the desired outcome of any major press conference: "get it over with and try not to give too much away Ben" might very well be Jean-Claude's advice.

The third answer has to be the most unlikely and that is: no, we will not end QE2 on schedule and are already working on plans to extend the program. While speculation is rife that this is the answer Ben Bernanke would personally like to give, the chances of him doing so are very low.

Why? Because while this answer could be just the thing the bulls want to hear, it would be very difficult to sell politically at a time when Washington is attempting to get past that S&P debt warning and find a solution on reining in the deficit.

The chances of Bernanke pushing ahead with QE3 without even waiting to watch the data are very slim indeed. The next day US first quarter GDP data could after all make the case for the need for as much support as possible from the Fed for the economy.