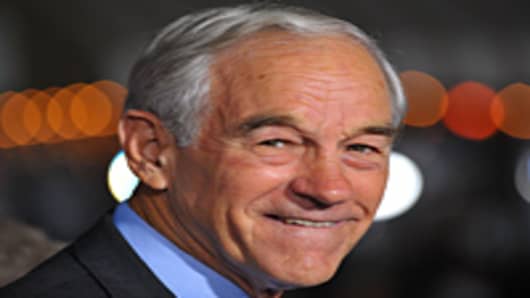

In Ron Paul's perfect world, there is no Federal Reserve, free markets rule and the President of the United States refuses to sign any budget bill unless Congress reduces spending.

But "we live in an imperfect world," Paul told CNBC Wednesday. "I’m not going to be able to get rid of the Fed."

"You don’t want one person dictating interest rates. You want freedom of choice and free markets," said the Texas Republican, who is making another run for the presidency.

"But we have to weaken the Fed. Eventually the most important thing we can do is take away the power of the Fed to monetize debt, and that would curtail the wild growth of government."

He blames Fed policies for deliberately devaluing the dollar and keeping interest rates so low there is no incentive for consumers to save.

"If you didn’t have the Fed buy the debt, interest rates would go up. We can borrow so much and tax so much. If interests rates would go up and the whole burden and the responsibility fell on the Congress they’d have to cut spending" to reduce the deficit, said Paul, a member of the House Banking Committee.

"The president is not a dictator but you have to lead the way and you have to get the Congress to cut back on the spending and just refuse to sign the bills," he said. "Veto the bills until they come up with some real spending cuts. I think the markets would respond very favorably."

Paul said if he was at the Fed's press conference he'd ask Chairman Ben Bernanke when he is "going to admit that you have to have something new and different to solve our problems."