Molycorp is ready to buy other rare earth mining companies should the opportunity arise, said Chief Executive Mark Smith told CNBC Wednesday.

"Molycorp is always interested in opportunities that increase shareholder value or add to our long-term business strategies," he said.

"We are looking at a number of opportunities. I've said before and I’ll say it again, there are more opportunities in the rare earth field today than I’ve seen in the past 25 years."

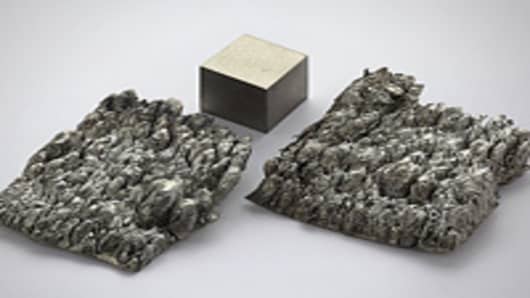

The Colorado company, with a market cap of $5.8 billion, made two acquisitions in April. It is the largest of the US miner of rare earths, a group of 17 elements that are widely used in consumer electronic items.

The US market as a whole is small at 13 percent, compared with China, which produces 70 percent of rare earth minerals.