But this investigation could be much more serious, according to a person at the Justice Department who is not involved in this investigation.

It's very likely that the Justice Department's investigation was spurred on by the 639-page report released in April by the Senate Permanent Subcommittee on Investigations. The report accused Goldman putting its interests ahead of its clients and misleading investors.

The report also said Goldman made a huge bet against housing and then sent the firm's executives to deny this at the committee's hearings.

Goldman's stance has always been that its short positions were hedges against long positions, rather than a one-way call on the direction of the housing market.

This conflict between what the subcommittee believes happened and what Goldman executives testified could result in criminal charges against Goldman, the Justice Department official said. Ironically, Goldman's accusers are saying the firm was smart enough to have figured out that housing would collapse and smart enough to figure out how to profit from the collapse, while Goldman defends itself by denying that it was that smart.

During the press conference announcing the April report, Senator Carl Levin said that he would refer the testimonyto the Justice Department for "possible perjury charges."

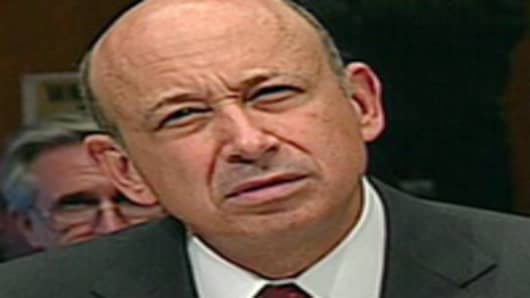

Lloyd Blankfein, the chief executive of Goldman Sachs, testified before the subcommittee. If the Justice Department's investigation determines that he wasn't honest in his testimony, he could face criminal charges.

It will probably be hard to make a perjury case against Blankfein. The subcommittee's finding that Goldman made a bet against the housing market was based in large part on the testimony of traders at Goldman.

Josh Birnbaum, one of the chief architects of Goldman’s short strategy, testified that “all retained CDO and RMBS positions were identified as already hedged.” In other words, when he started shorting mortgages, he wasn't hedging. He was taking a directional bet.

But Birnbaum's testimony might be viewed as self-serving. It makes him out to be the heroic genius trader who correctly called the market. In his internal self-assessments at Goldman, made public during the hearings, Birnbaum touts his market prowess. Reportedly, he urged that he and his team get bigger bonuses for their call.

Emails between top executives at Goldman from 2007, however, seem to indicate that they did not consider the positions Birnbaum was taking to be a "bet."

“Also, the short position wasn’t a bet. It was a hedge. I.e., the avoidance of a bet. Which is why for a part it subtracted from var, not added to var,” Blankfein wrote to some of his fellow executives.

That might be the email that saves Blankfein from criminal charges.

It's not a crime to disagree with your traders. And Blankfein likely had a better understanding of firm-wide exposure than Birnbaum.

Can you imagine that? A Wall Street executive actually being saved from legal jeopardy by an internal email. There's a first time for everything.

___________________________________________

Questions? Comments? Email us atNetNet@cnbc.com

Follow John on Twitter @ twitter.com/Carney

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC