Earlier this week, when we got the report of a bump up in sales of newly constructed homes, I cautioned that the home builders are still facing huge competition from distressed properties (foreclosures and short sales). Today we have some new numbers showing just how big and how widespread that competition is.

Foreclosed properties made up 28 percent of all home sales nationwide in the first quarter of this year, according to RealtyTrac.

That's up slightly from Q4 of 2010, but not the record 29 percent we saw a year ago. More than 107,000 bank-owned (REO) properties sold, which is actually a drop from the previous quarter and a bigger drop (36 percent) from a year ago. Foreclosed properties sold at a 35 percent discount to their non-distressed counterparts.

So here we have fewer selling but making up a larger share of total sales. That's not particularly healthy. We need to get more of these properties sold, because as I showed you on the blog Tuesday, there are hundreds of thousands of them and millions more in the potential pipeline.

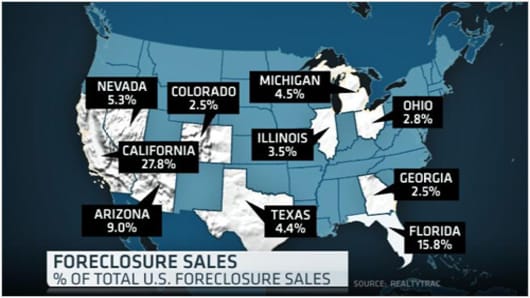

This is not exactly news, but every time I report it I get the argument back here on the blog that these distressed sales are only happening in certain states and don't affect the overall housing market. There is some truth to that, at least the first part. I asked RealtyTrac to pull some other numbers for me to show what I'm talking about.

More than three quarters of all distressed sales (78 percent) were in just ten states:

You can see the usual suspects, California, Florida, Arizona, Nevada and much of the Mid-West. That's a problem for the builders because so much of their most recent inventory is in those states. But what about the rest of us?

It begs two questions: 1) If I don't live in these states, why should I care? 2) If the worst is only in a few states, then why are home prices falling nationwide?

Here's RealtyTrac's Rick Sharga's explanation:

"The 10 states include several of the states with the highest number of overall home sales; driving prices down in California and Florida has much more impact on national averages than fluctuating home prices in Alaska and Wyoming.

It's not all about geography. While foreclosure sales obviously depress the price of homes nearby, they also affect prices by limiting new home sales, which typically help drive home prices up. But foreclosure sales are only one of the factors behind falling home prices. Weak demand is probably the biggest driver."

And I contend that weak demand is driven by several factors, not the least of which are credit and confidence. The banks are looking at their overall book of business and the losses they're still taking; the losses are concentrated in those states that are continuing to suffer the most. Regardless, they spread that pain nationwide in their lending standards, tightening up to the point that many borrowers far far away from California can't get a loan.

Confidence, or lack thereof, is a bigger factor than we often give it credit. Yes, the big bad media report all these numbers, and yes, some of the worst of it is nowhere near where you live, but you see and process it. It affects your confidence and consequently how you act.

Housing demand is nowhere near where it should be, and the mix of what is selling is all on the low end. Investors with cash and first time home buyers are bargain hunting, and that pushes the price average/median down in every market. As prices fall on real sales, thousands of borrowers fall underwater on paper...on their mortgages, and that puts them at higher risk of foreclosure.

"Residential home sales fell by 18 percent in Q1 2011 compared to Q4 2010 and by almost 32 percent from Q1 2010," notes Sharga. Foreclosures and distressed sales, even if they're not in your back yard or in your state, affect your home's value because they affect the overall demand for your home.

Questions? Comments? RealtyCheck@cnbc.comAnd follow me on Twitter @Diana_Olick