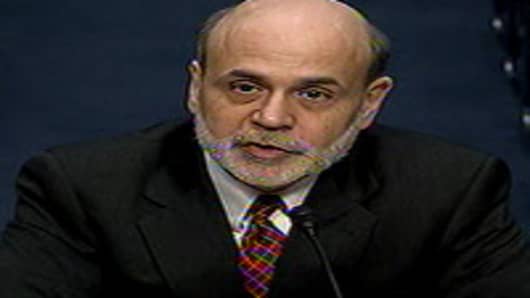

Fed Chairman Ben Bernanke weighs in on the economy Tuesday, and he is expected to acknowledge the recent slowdown but may withhold a view on the duration.

Bernanke speaks to markets that will be hypersensitive to any sign that the slowdown in growth could be more than just a short-term stall out. His comments also come just several weeks before the Fed is to scheduled to end its quantitative easing program, and investors will be looking for any sign of where the Fed stands on its extraordinary easing policies.

Bernanke speaks ahead of the market close, at 3:45 p.m. ET, at the International Monetary Conference in Atlanta.

"If I'm at the Fed, I'm very much in a wait and see mode. I don't want to seem too sanguine, and look like an idiot two months later if things do turn down. I also don't want to be complicit in talking the economy down. Definitely if I'm Bernanke, I want to take an agnostic stance. These latest numbers have not been very good," said Stephen Stanley, chief economist at Pierpont Securities.

Boston Fed President Eric Rosengren told CNBC's Steve Liesman Monday that it's too soon to know whether the slowdown is more than temporary and that it's too early for the Fed to consider any further bond purchases. Many Wall Street economists believe the softness in the second quarter will be short-lived and was brought on by Japanese supply chain disruptions and higher oil prices.

Rosengren said the slowdown does have the potential to change the timing of the Fed's exit from its other easing programs. The quantitative easing program finishes at the end of June and involves the purchase of $600 billion in Treasury securities. But the Fed will continue a separate program to reinvest proceeds from its mortgage portfolio in Treasurys, plus it is undetermined when the Fed may make moves to reduce the size of its balance sheet.

Brown Brothers Harriman Chief Currency Strategist Marc Chandler does not see Bernanke setting off any alarms on the economy when he speaks. "My sense is he's going to be cautiously optimistic still, mentioning that some of the head winds are temporary, like the bad weather and the Japanese supply stuff. Bottom line, he'll recognize the weakness of the economy without endorsing" it's going to stall forever, he said.

There is little data Tuesday, but consumer credit is released at 3 p.m. Also of note are major events for the auto industry, including Ford's investor day and GM's annual meeting. Both will be watched for any news on the industry's ramp up in production and outlook on sales, which were softer in May.

In a note Monday, Deutsche Bank U.S. economist Joseph LaVorgna said the cutback in auto production from the supply chain disruptions could be weighing on the economy more than initially expected. He said in the May employment report, released Friday, hours worked for motor vehicle workers were down 3.1 percent in May, following a 3.8 percent decline in April.

He said it appears motor vehicle production fell four percent in May, after an 8.9 percent decline in April, taking the level of production down 29 percent at an annualized rate for the second quarter, compared to the first quarter. If that trend continued in June, it would be the steepest drop on record, greater than the 23 percent in first quarter, 2009, he noted.

In a note, LaVorgna wrote: "..a near 30 percent decline in motor vehicle production is consistent with roughly a two full percentage point drag on Q2 real GDP. In our forecast, we are assuming a decline of around 1.5 percent because we think that we might see a small bounce in June production" that would result in a 20 percent decline.

"If there is good news here, it is that the negative hit to production is due to Japanese-related supply disruptions — they turned out to be much more serious than we had anticipated," he wrote. Because the disruption was due to a natural disaster, not economic fundamentals, he expects the soft patch to be temporary.

Whither Markets

Stocks sagged Monday, as the S&P 500 broke through key technical levels. Analysts had looked to the 1295 level to provide some support, but the S&P slid below that and also fell below 1288, its 150-day moving average. The S&P was down 1 percent at 1286, its lowest close since March 18, and the Dow was off 0.5 percent at 12,089. The worst performing sector was energy, down 2 percent, followed by the financials, down just under 2 percent.

John Roque, Managing Director at WJB Capital Group, said the S&P still has a ways to fall. "1250 is going to happen. It was 1300 this morning, we're half way to 1250," he said. The next levels to watch if 1250 does not hold are 1220 to 1227.

More importantly than the S&P are the financials, which he sees falling much further. "The more important call is 'are you short financials?' The S&P is up 2 percent for the year. The financials are down 7 percent," he said in a quick phone interview. In a note, he included a chart that showed the financials forming a head and shoulders pattern, where the financials appear to be beginning the decline in the second shoulder.

Rochdale Securities cut Wells Fargo to sell from neutral Monday, and banks in general weakened on concerns about potentially higher capital requirements in a weakening economy.

Roque said other negative signs for the stock market include a decrease in the number of stocks making new highs. "For the first time in more than a month, last Friday's action produced a negative net new high figure on the NYSE... And, the 10-day moving average of new highs is down to 89 while the 10-day moving average of news lows has risen to 32," he wrote in a note.

Many strategists have expect the market to chop sideways to lower for now, but pick up later on and finish higher for the year.

As stocks waffled, bond yields rose as prices fell. The government auctions $32 billion in 3-year notes at 1 p.m. Tuesday. The yield on the 10-year was at 3.01 percent.

The dollar ended higher Monday, extending gains against the euro, after Jean-Claude Juncker, who heads the team of euro zone finance ministers, said the euro is overvalued. The euro was at 1.4577. The currency was also weaker on uncertainty about a second Greek bailout.

"My sense is we're (the euro) going to bounce back here. Bernanke's going to speak. Can he say anything good about the economy? And (ECB President Jean-Claude) Trichet speaks Thursday and he's going to point to an interest rate hike. I'm still optimistic on the euro," said Chandler.

Questions? Comments? Email us at marketinsider@cnbc.com