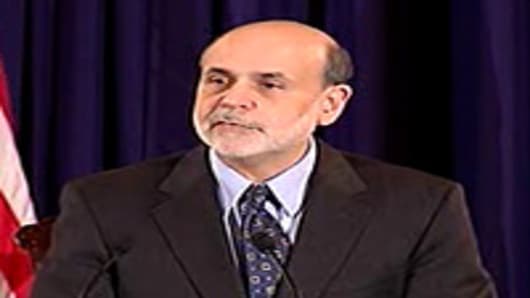

Stock markets would panic if they knew what Ben Bernanke and other leading figures in the Federal Reserve really said when their tongues are loosened by alcohol, John Mauldin, president of Millennium Wave Advisors, told CNBC Thursday.

“If they really told us what they are talking about after three glasses of wine late at night, the markets would wet their pants and it would be all over,” Mauldin said.

“There’s some things we don’t want to know.”

Mauldin added: “This is the same Ben Bernanke that said the subprime risk will be contained.

“Central bankers in the US aren’t central bankers, they become politicians.”

After a two-day Federal Open Market Committee meeting, the Fed slashed its growth forecast for this year Wednesday and said unemployment will still remain high.

The Fed now predicts that the economy will grow between 2.7 percent and 2.9 percent this year, down from its April estimate of between 3.1 percent and 3.3 percent.

“The problem is that all the data that keeps coming out shows that the US is getting softer. The Fed is in a hard place,” said Mauldin.

“We are going to have to do in a small sense what Greece is having to do in a large sense.”

“The Americans have a British problem,” Nick Beecroft, senior markets consultant at Saxo Bank, told CNBC Thursday.

“Ben Bernanke must feel akin to Mervyn King. Both have high growth and rising inflation.

Bernanke said that interest rates would remain at current levels for at least two more meetings of the FOMC. The Bank of England has also indicated that interest rates will remain at their current historic low of 0.5 percent in the short term.

The US is entering a sustained period of slow economic growth, according to Maulkin.

“We are going to have to cut our deficit by about one percent each year,” he said. “That puts us into a slow growth economy.”