On Monday investors were taking a hard look at the S&P, attempting to make heads or tails of the gains.

At issue was whether investors were starting to feel better about risk – or if stocks simply bounced after 3 days or losses.

Part of the gains stemmed from improved clarity in the financials . Global banking regulators in Basel said banks may have to increase their reserves by 2.5%, less than the 3% some investors had feared.

Also, investors grew more hopeful that Greece will take the necessary steps to get the next bailout payment. Helping to ease tensions, French President Nicolas Sarkozy said his government had an agreement with French banks on rolling over Greek debt into new 30-year bonds.

Adding to the optimism, the S&P held above its 200-day moving average of around 1,260 after two months of heavy selling. “That’s been critical,” says trader Steve Grasso. “That’s the line in the sand.”

All told, these developments seem to suggest that 1260 should be the bottom.

However, both Jon and Pete Najarian are watching another area of the market and they don’t like what they see.

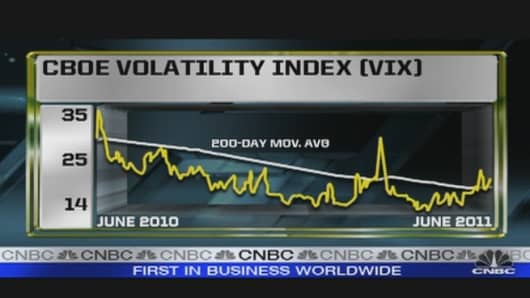

The Vix continues to hold above the 200-day.

“It’s saying there’s fear and uncertainty built into the S&P at this level,” explains Pete Najarian. In other words, investors are not endorsing the current level of the market, whole-heartedly.

At this level, the market is looking for a move – explains Pete Najarian – as much as 15 or 16 points, albeit it could come in either direction.

Jon Najarian thinks the market may be fearful of the move by France, mentioned above. In other words, investors may be wondering if rolling over the Greek debt is actually smoke and mirrors.

”The Vix says investors fear there could be another shoe to drop,” Jon Najarian explains. “Bulls are happy about Monday’s gains, but also, they remain skeptical.”

What should you make of it?

The action in the Vix makes technical levels on the S&P – all the more important. If you’re placing new bets, both the Najarians and Steve Grasso suggest keeping an eye on 1260. “If it breaks look at out,” explains Grasso.

Adding to the skepticism, the latest economic data showed consumer spending stagnated in May after 10 straight months of gains. The Street largely interpreted the data as a sign that higher prices at the pump had started to take their toll.

But trader Brian Kelly thinks $4 gas may be a thing of the past - at least for the remained of 2011. “The world changed last Thursday with the release from the SPR,” he says. In other words, governments of the world forced out speculators by demonstrating they're willing to suddenly and without warning increase supply. As a result Kelly expects gas prices to moderate and consumer spending to recover.

In fact, expectations of lower gas prices might 'really' be behind Monday’s gains, Kelly speculates. Tech and consumer discretionary were among the leadership groups. And typically both respond well to lower oil .

---------

COMMERCIAL BANKS GET CAPITAL CLARITY

Financials led the S&P 500 higher on Monday as investors got more clarity on capital reserves from the bank of international settlements.

Specifically, banks will have to hold up to an additional 2.5% of capital on their balance sheets to protect them in event of another crisis.

What should you make of it?

Find out from Credit Suisse managing director Moshe Orenbach?

______________________________________________________

Got something to to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap. If you'd prefer to make a comment, but not have it published on our Web site, send those e-mails to fastmoney@cnbc.com.

Trader disclosure: On June 27, 2011, the following stocks and commodities mentioned or intended to be mentioned on CNBC’s "Fast Money" were owned by the "Fast Money" traders; Pete Najarian is long (AAPL); Pete Najarian is long (C); Pete Najarian is long (MS); Pete Najarian is long (MRVL); Pete Najarian is long (CROX); Pete Najarian is long (TCK); Pete Najarian is long (MOS); Pete Najarian is long (AKAM); Pete Najarian is long (GE); Pete Najarian is long (TEVA); Pete Najarian is long (PFE); Pete Najarian is long (MRK); Pete Najarian is long (UNP) calls; Pete Najarian is long (MSFT); Grasso Owns (AKS); Grasso Owns (AMD); Grasso Owns (ASTM); Grasso Owns (BA); Grasso Owns (BAC); Grasso Owns (C); Grasso Owns (D); Grasso Owns (HOV); Grasso Owns (JPM); Grasso Owns (LIT); Grasso Owns (LPX); Grasso Owns (MHY); Grasso Owns (NDAQ); Grasso Owns (PFE); Grasso Owns (PRST); Jon Najarian owns (AAPL) call spreads; Jon Najarian owns (AMSC) call spreads; Jon Najarian owns (CTXS) call spreads; Jon Najarian owns (UA) call spreads

For Steve Grasso

Stuart Frankel & Its Partners Own (ABX)

Stuart Frankel & Its Partners Own (CSCO)

Stuart Frankel & Its Partners Own (CUBA)

Stuart Frankel & Its Partners Own (GERN)

Stuart Frankel & Its Partners Own (HES)

Stuart Frankel & Its Partners Own (HPQ)

Stuart Frankel & Its Partners Own (HSPO)

Stuart Frankel & Its Partners Own (MU)

Stuart Frankel & Its Partners Own (MSFT)

Stuart Frankel & Its Partners Own (NYX)

Stuart Frankel & Its Partners Own (PFE)

Stuart Frankel & Its Partners Own (PRST)

Stuart Frankel & Its Partners Own (RDC)

Stuart Frankel & Its Partners Own (SDS)

Stuart Frankel & Its Partners Own (UAL)

Stuart Frankel & Its Partners Own (XRX)

Stuart Frankel & Its Partners Are Short (QQQQ)

Stuart Frankel & Its Partners Are Short (AAPL)

For Brian Kelly

Accounts Managed By Brian Kelly Capital Are Long the Euro

Accounts Managed By Brian Kelly Capital Own (ANDE)

Accounts Managed By Brian Kelly Capital Own (JPM)

Accounts Managed By Brian Kelly Capital Own (WFC)

Accounts Managed By Brian Kelly Capital Own (TOL)

Accounts Managed By Brian Kelly Capital Own (MON)

Accounts Managed By Brian Kelly Capital Own (IPI)

Accounts Managed By Brian Kelly Capital Own (CLF)

Accounts Managed By Brian Kelly Capital Own (ESV)

Accounts Managed By Brian Kelly Capital Own (CAF)

Accounts Managed By Brian Kelly Capital Own (FCX)

Accounts Managed By Brian Kelly Capital Own (MCP)

Accounts Managed By Brian Kelly Capital Own (TCK)

Accounts Managed By Brian Kelly Capital are long the Hong Kong Dollar

Accounts Managed By Brian Kelly Capital Are Short the Yen

CNBC.com with wires.