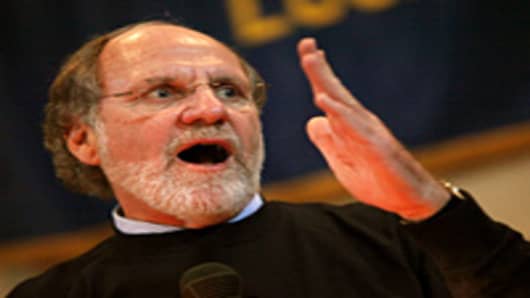

The so-called “key man provision” promises that MF Global would pay an additional 1 percent in interest if Corzine left to join the administration before July 1, 2013. MF Global says the provision was included at the request of underwriters, which may indicate that bond buyers at least believe they have reason to fear Corzine could leave the company.

MF Global says Corzine has not been offered any position in the administration and remains committed to MF Global.

But that’s the kind of non-denial denial that only raises more eyebrows. No one in the world thought Corzine had already been offered the position. Secretary Tim Geithner hasn’t even said he is leaving yet, so any offer would be premature.

But two people close to the administration and a person at the Treasury Department say that they believe Corzine has been “angling” for the job. All three sources used that same word, “angling.”

“What I mean by ‘angling’ is that he’s staying in touch with the right people, letting them know that he’s available without seeming too eager,” one of the two sources close to the administration said.

Some regard the possibility of Corzine being tapped as farfetched.

There are many other plausible candidates whose names are mentioned more frequently in connection with Treasury. They include Obama administration fiscal reform advisor Erskine Bowles, General Electric CEO and Obama adminstration jobs czar Jeff Immelt, White House chief of staff Bill Daley and JPMorgan Chase CEO Jamie Dimon.

Corzine has strengths that many of the other possible candidates for the job lack. He is appealing to Obama’s liberal base at a time when many liberals feel alienated from the administration. He has been outside of Washington for several years, and outside of government since losing the New Jersey governorship to Chris Christie. He still has deep connections on Wall Street, making him a possible fundraising champion for the Obama administration.

Many of the names mentioned as possible successors to Secretary Geithner have far less appeal to the liberal base.

Erskine Bowles is disliked by progressives for his role in the deficit commission, which suggested lowering top tax rates. Immelt and Dimon are considered too closely linked to corporate American and Wall Street.

Daley has turned off some progressives for his role in helping forge the debt ceiling compromise, which they dislike, but he still has strong progressive credentials.

Corzine had one of the most liberal records in the U.S. Senate. As governor of New Jersey he signed important workers rights and environmental legislation. Many self-styled “progressives” believe that he is “one of us,” one person involved in Democratic politics for several decades explained.

Corzine’s deep connections to the liberal base of the Democratic party could make him immune to the criticism that he is too close to Wall Street, despite the fact that he once was at the head of Goldman Sachs . Or, at least, more immune than Erskine Bowles (who is a director of Morgan Stanley ) and Jamie Dimon. What’s more, MF Global didn’t require TARP funding during the financial crisis, taking away one of the sources of anti-Wall Street sentiment.

Even Corzine’s setbacks might be strengths when it comes to progressive support. Losing the governorship to Chris Christie is seen by many as unfortunate but hardly damning. Christie is despised by the left wing of the Democratic party. Those that had worried Corzine had drifted too far right as governor of New Jersey now find themselves pining for the pre-Christie days.

“In retrospect, we should have been behind Corzine far more than we were,” said a longtime veteran of New Jersey Democratic politics.

Corzine was reportedly forced out of Goldman Sachs by Henry Paulson, who went on to become Treasury Secretary under President George W. Bush. This endears Corzine to some Democratic supporters. “If Paulson thought this guy was an enemy, how bad could he be?” the Jersey politics vet said.

All of this speculation may be very premature. Geithner does not look like he is going anywhere, despite speculation he would leave shortly after the debt ceiling fight. There’s been speculation Geithner would leave almost since he first took office. And many wonder whether or not Corzine would want to take a job in the final year of Obama’s first term—especially if the second term seems in doubt.

A 1 percent interest hike for MF Global is so steep that some on Wall Street believe the “key man” provision is being misinterpreted. They say it is a sign that Corzine is definitely not leaving—at least not until 2013, during what would be Obama’s second term in office.

“He may get the job as Treasury Secretary. But he doesn’t want it until after the election. Why leave for such shaky job prospects?” said one person who used to work under Corzine at Goldman. The person said he had not had a conversation with Corzine in years.

Some on Wall Street believe Corzine may attempt to arrange for MF Global to be acquired by a larger competitor. They think he won’t leave until he’s completed an acquisition that handsomely rewards shareholders for naming him as CEO.

One possibility that is whispered about in Washington is that Corzine might be on the short list for something even higher up the ladder than the Treasury Secretary.

“Who’s to say that he’s not going to be the next vice president?” a Capitol Hill source asked.

Questions? Comments? Email us atNetNet@cnbc.com

Follow John on Twitter @ twitter.com/Carney

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC