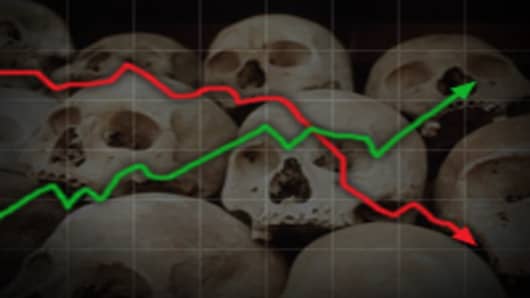

Pado says there's a lesson to be learned from the death cross that formed in July 2010, when stocks did not enter a bear market, but instead were setting up for another rally that started at the end of the summer.

The 50-day moving average of 1111.66 crossed beneath the 200-day moving average of 1111.77 on July 2. The market closed that day at 1022. "It then crossed back above on October 22," when the S&P was at 1183, he said.

Investors would have missed that rally had they heeded the warning of the death cross. "You would have missed a 160-point move in the S&P because you saw this vampire cross!" said Pado.

Questions? Comments? Email us at marketinsider@cnbc.com