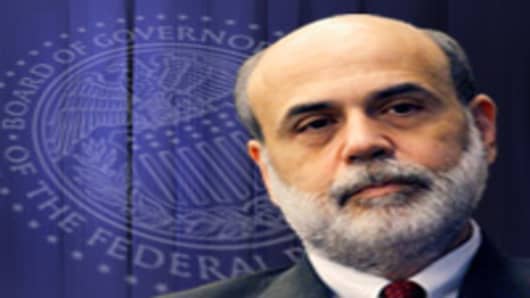

Federal Reserve Chairman Ben Bernanke said the Federal Reserve stands ready to use additional tools to help the US economy in its nascent recovery, but he stopped short of explicit talk that another round of monetary easing is forthcoming.

The central bank chief's hotly anticipated remarks at Jackson Hole, Wyo., did not entail promises of more quantitative easing —QE3 in market parlance—nor did he discuss specific measures on whether the Fed will make any other attempts at intervention.

Citing "a range of tools that could be used to provide additional monetary stimulus," he said the Fed "will continue to consider those and other pertinent issues, including of course economic and financial developments, at our meeting in September, which has been scheduled for two days instead of one to allow a fuller discussion," Bernanke said in the speech.

As the economy languishes in low growth and stock market endures a summer correction, Bernanke's speech was considered a bellwether for what will lie ahead.

Instead, he mostly reiterated language already used by the Federal Reserve , in which it has expressed concern about the pace of economic recovery.

"It is clear that the recovery from the crisis has been much less robust than we had hoped," he said.

But the chairman seemed to put an end to talk that the Fed was willing to react simply because the stock market was in correction mode and worries have intensified that the economy could be heading for another recession.

"We heard from Gentle Ben rather than Hurricane Ben," Robert McTeer, former Dallas Fed president and distinguished fellow at the National Center for Policy Analysis, told CNBC. "The choice in monetary policy isn't between QE3 and doing nothing...No QE3 does not mean the Fed is just backing away and not doing anything."

Bernanke also said he expects growth to pick up in the second half. Should signs fail to materialize soon, the Fed's Open Market Committee will consider additional policy tools at its Sept. 20-21 meeting, which has been extended to two days.

He said inflation is likely to stay below 2 percent, which would meet Fed expectations and its mandate for price controls. However, that only pertains to so-called core inflation, which excludes food and transportation costs and is around 1.8 percent on an annualized basis. Headline inflation, which includes the more volatile measures, is at 3.6 percent.

Dissenters on the Fed in part fear that the Fed's policies, which have driven down the US dollar against the world's currencies, are in turn pushing inflation higher.

Markets sold off sharply but briefly following word that the Fed would not deliver on QE3 expectations, with the Dow industrials sinking more than 150 points.

However, the selloff was short and orderly and quickly calmed, with the market eventually turning positive on indications that investors were far from unanimous in their quest for QE3.

"Bernanke didn’t play the panic card and throw another QE program at the economy," said Keith Springer, president of Springer Financial Advisory in Sacramento, Calif. "This will ultimately instill confidence in investors as they will be pleased by his non-action because if more stimulus was needed he would have applied it."

Bernanke used his Jackson Hole speech last year to tip his hand about QE2, sparking a sharp move higher in the stock market. The Fed did not actually begin the round of easing until November with a series of purchases amounting to $600 billion in Treasurys.

On the jobs front, Bernanke said economic growth is not sufficient to bring down the 9.1 percent unemployment rate. He called on Washington to develop "good proactive housing policies" to address a real estate market at depression levels.

"Even as tight credit for some borrowers has been one of the factors restraining housing recovery, the weakness of the housing sector has in turn had adverse effects on financial markets and on the flow of credit," he said.

But when it came to specific language regarding Fed action, he remained vague.

"The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger economic recovery in a context of price stability," he said.