Ahead of President Obama's highly anticipated jobs package unveiled on Thursdayin front of Congress, and CEOs on CNBC this week had some tough words for the president.

An NBC/Wall Street Journal poll showed Obama's overall job approval rating at a low of 44 percent, down 3 percentage points since July, while his handling of the economy stands at 37 percent.

Donald Carty, chairman of Virgin America and former AMR chairman and CEO, noted "there's very little expectation about [Thursday's] speech or anything that will happen in the next eighteen months."

Lack of confidence is a result of the government's inability "to delvelop a plan to fix these problems," he added. "Demand is not going to come back in the U.S. because everybody is holding back because of this concern."

"The uncertainty lies in the fact that we know there are fundamental problems in this economy—they're severe, they're significant," Cart went on to say.

John Schiller, chairman and CEO of Energy XXI, said "if the government would get out of the way, from a regulation standpoint, and let us [XXI] do what we do good you'll see us continue to hire and grow this economy."

"I think that's a message from across the board," said Schiller.

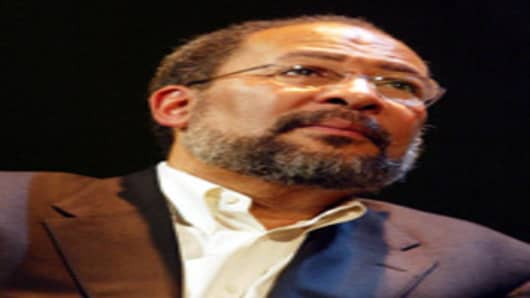

Richard Parsons, chairman of Citigroup, told CNBC there are some specific things that can be done "in terms of moving government out of the way where its in the way of job creation."

"The President is trying to be pro-business. He's [Obama] trying to do what he can to work with the business community," added Parsons.

Joe Echevarria, Deloitte's new U.S. CEO stressed that growth comes from offering incentives to the private sector "through tax reform, regulation and responsible fiscal policy."

But it needs to be done in a "pragmatic" way with a responsible government and less politics," he said.

Heather Bresch, CEO of Mylan Labs, said unemployment is "tough to band-aid when it’s of such epic proportions."

"There needs to be a real recognition of what is job creation and that there’s a difference between a government job and a private sector job...We really need to step back and live within our means," added Bresch. "That’s a very tough pill for everybody to swallow and I think given the partisan of what Washington has become, they’re not putting America first."

Liam McGee, CEO of Hartford Financial Services Group, stressed the importance of creating "incentives for businesses and entrepreneurs to invest—hire people in their plant, equipment and grow."

"We ought to be celebrating our entrepreneurs," McGee added, "and those who are creating vibrant businesses and creating jobs."

Jon Faraci, CEO of International Paper, told CNBC "to create jobs what we need is demand. This economy is 70 percent consumer driven, so we need consumers spending some of their discretionary income if we're going to have demand that's gong to lead to more jobs."

"If we get demand, we’ll put more shifts on, our employees will be working more hours, and we’ll hire more people. Without demand we can have all the certainty in the world and all the clarity about regulation, but to me it’s not so much about confidence as it is about demand," explained Faraci.

Indra Nooyi, chairman and CEO of PepsiCo, noted that "anything that's done to address unemployment in terms of massive stimulus spending is going to exacerbate deficits. And anything that's done to address deficits in the short-term is going to exacerbate unemployment."

Nooya went on to say we're in "a bit of a policy box and it's going to require us being willing to give up one of the two, which is it's okay to take on more deficits but lets put in some massive spending. Alternatively to say, 'we're going to go through structural unemployment for a while because we want to address deficits.'"

At this point I think we are all trying to address this conundrum by saying we have to address both sides, unfortunately there is no way out of this," Nooya added.

Michael George, CEO of QVC, noted the importance of "making sure that there's a tax code and an investment code that supports the formation and growth of small businesses."

"We need a cohesive plan to grow jobs, and to restore some confidence that the government can work and make decisions" in order to move forward, George went on to say.