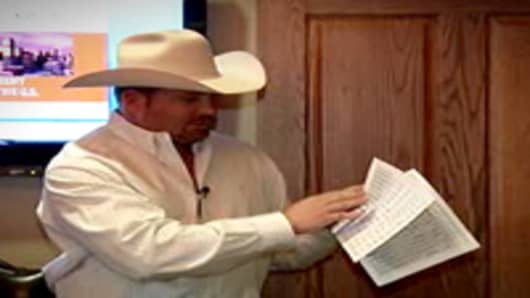

It was just hitting 105 degrees in Dallas when Phillip Carter herded a group of Australian investors onto a bus and headed out to see some previously foreclosed properties. Cowboy to cowboy, Carter tells them the Dallas market is ripe for profit, as rental demand surges and rents head higher. The difference in his business model is that the cash is ready to flow, immediately.

"We buy foreclosures in bulk from the banks, REO's, and rehab them and sell them with property management," says Carter, who sells his properties complete with renters. "It's a turn-key package that provides cash flow."