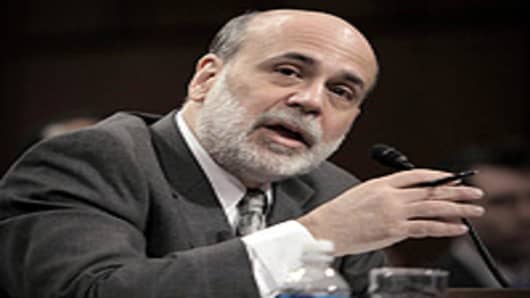

The U.S. can learn how to boost long-run growth from successful emerging economies, U.S. Federal Reserve chairman Ben Bernanke said in a speech on Wednesday that will delight developing countries more used to admonishment than admiration from Washington.

“Advanced economies like the U.S. would do well to relearn some of the lessons from the experiences of the emerging market economies,” said Mr Bernanke.

The Fed chairman’s comments at a forum in Cleveland, Ohio, send an indirect but pointed message that Washington is ignoring the advice it doles out to developing countries.

Emerging market growth shows “the importance of disciplined fiscal policies, the benefits of open trade, the need to encourage private capital formation while undertaking necessary public investments, the high returns to education and to promoting technological advances, and the importance of a regulatory framework that encourages entrepreneurship and innovation while maintaining financial stability”, said Mr Bernanke.

Political battles between Republicans and Democrats mean that Congress has struggled to tackle the U.S. fiscal deficit and has not passed free trade agreements with Korea, Colombia and Panama. Where it has made spending cuts, the focus has been on discretionary areas such as scientific research rather than benefits such as healthcare and pensions.

Mr Bernanke has steadily increased his pressure for a U.S. fiscal policy that combines short-run stimulus with long-run tightening even as the Fed has eased monetary policy further. Last week, the Fed began “Operation Twist”, under which it will buy more long-dated Treasuries in an effort to drive down long-term interest rates.

On Wednesday, the Fed chairman also said that many emerging markets “can no longer view themselves as small, open economies whose actions have little effect on their neighbors” and need to take greater responsibility for the stability of the world economy.

“Large and persistent imbalances in trade are also inconsistent, in the long run, with global economic and financial stability,” said Mr Bernanke. That is an implicit criticism of countries such as China that have held down their exchange rates in order to boost exports, although he noted that advanced economies must also help to reduce global imbalances.

In a review of the growth of emerging markets, Mr Bernanke said the reforms that make up the “Washington consensus” – a controversial package of measures urged on developing countries over the last couple of decades – “have much to recommend them”.

“Macroeconomic stability, increased reliance on market forces and strong political and economic institutions are important for sustainable growth,” said Mr Bernanke. But he said that the past 20 years had proved that the Washington consensus was incomplete, because the sequence of reforms matters, and governments may need to help start industries that are big enough to reap economies of scale.

For example, accepting large flows of capital from abroad without first reforming the domestic financial system can lead to a financial crisis in a developing country.