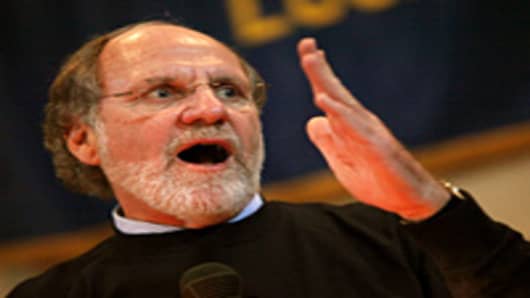

It’s still a bit of mystery what happened to MF Global. We know Corzine oversaw an increase in the risks the firm took, especially in European fixed income. The firm is leveraged something like 40 to 1. It’s very dependent on the confidence of lenders to stay in business.

All the very serious people on Wall Street keep saying that the problems at MF Global are “isolated” or “unique.” It’s not a bellwether or a canary in the coal mine, they say.

I’m not so sure. There were lots of firms that were supposedly not canaries in coal mines in 2007. Heck, even the entire subprime market was supposedly not a canary in the coal mine for the broader housing market.

See, for example, The Wall Street Journal’s“Subprime Fallout May Not Infect Broader Market” from March 12, 2007.

A couple of months later, we were hearing from Bank of America analyst Michael Hecht that the hedge-fund failures at Bear Stearns were “isolated issues.” They were not, as Bloomberg put it, “indicative of a wider problem at the firm.”

Except, you know, they kind of were indicative of a wider problem, and the problem was not just at Bear Stearns but all across Wall Street. It wasn’t just a problem—it was a near-death experience for the American financial system.

So, yeah, the sudden collapse of MF Global makes me very nervous.

As a financial journalist, you are barely allowed to say that. It’s irresponsible. Fear-mongering. Run-on-the-banks inducing.

So let me say again: The smart and serious people tell me that I have nothing to worry about.

We don’t really know very much about the exposure of bigger Wall Street firms to Europe, except that they say that they aren’t very exposed and that their exposure has been reduced or hedged. Only we don’t know how they reduced that exposure or hedged it, so we just have to cross our fingers and trust the brilliant minds who brought us 2008.

The smart people keep telling me: This isn’t a canary, we aren’t in a coal mine, MF Global isn’t systemically important, don’t frighten the miners with your talk of financial crisis.

The smart people were telling me that right through the summer of 2008.

Questions? Comments? Email us atNetNet@cnbc.com

Follow John on Twitter @ twitter.com/Carney

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC