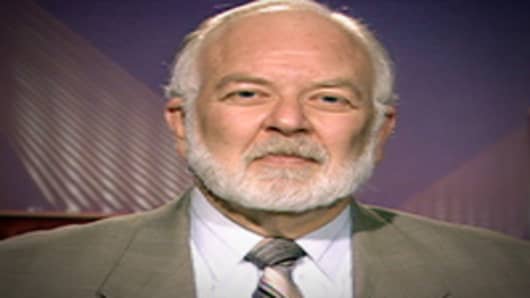

Investors dumping U.S. bank stocks are overreacting to all the European debt crisis speculation, Rochdale Securities’ Dick Bove told Larry Kudlow Tuesday.

“I think we’ve gone nuts,” he said. “I think these [U.S. bank] stocks are so cheap, that people should be buying them as aggressively as they could.”

The financials lead the S&P lower Tuesday after investors fled the market on fears that the European debt deal could fall apart. After conflicting reports on whether Greece plans to hold a referendum on the debt agreement reached last week, the government jumped in to say the vote is on.

But what's happening in Europe should not affect U.S. banks, Bove said, because most have virtually no exposure to the EU. Plus, most banks beat their earnings estimates for the third quarter.

As for the “five big American banks” that do have exposure to Europe, their risk is “not very great at all.”

That’s because Bove believes the EU will not let its banks fail.

“The ECB will do, if you want, a QE2,” he said. “It’s going to save all of the major European banks. It’s already shown its will to do so.”

CNBC.com with wires

Questions? Comments, send your emails to: lkudlow@kudlow.com