MF Global's bankruptcy has stunned the investment world and left investors with exposure to the financial firm anxious. CNBC talks to corporate lawyer Tom Curran about the steps affected investors need to take going forward. Curran is Securities Lawyer & Partner at Peckar & Abramson. His practice includes advising corporate management and boards on regulatory matters as well as taxes and employee relations. He is a former prosecutor with the Manhattan District Attorney’s office.

What is the first thing investors in MF Global should be doing right now?

If you’re an investor in MF Global, your life today is about maximizing your options, and maximizing your chances of recovery.

The first thing you do is you put in claims everywhere you can. And you must gather all the facts.

Where should you file claims?

You should file a claim in bankruptcy court for the amount you believe to have been in your account, based on your last statement.

You are certainly going to make a claim with SIPC, which covers maybe 1 percent of what MF Global had. Their investors were not little old ladies from Pasadena, but large institutions with high risk tolerance for trading large currency futures and making currency bets. Very risky stuff.

It seems the SEC is making an initial inquiry, so from that standpoint you're going to want to engage someone to sniff out where the inquiry is—in NY, in DC—and who’s handling it. You want to raise your concerns with them.

JP Morgan Chase is the biggest investor in MF Global. Might they have other options?

JPM Chase likely has their own insurance and will need as much information as possible to make their own claim. The insurance company will likely ask: did you file a report with law enforcement when you suspected your money was missing? Law enforcement could be the FBI, the Manhattan DA, the NYPD, the NY Attorney General. Just like a homeowner's policy, you'll have to show you made a report to the police.

SIPC has a limit of $500,000. Would a big investor even bother?

Yes, you’ll file because it might be all you’re going to get. And SIPC will quickly want to move the accounts out of MF Global to somewhere else. It maximizes their value in the bankruptcy. The accounts are worth something today, but if you wait til tomorrow they could be worth nothing.

And what steps can investors take if it turns out there was fraud?

It’s been reported that $700 million is missing and unaccounted for. You're going to try to get information about that from SIPC, the SEC, and perhaps the FBI. If you feel that your money is gone, you should reach out to law enforcement.

You should collect every possible piece of information you have. This could include: statements, emails, public filings about their positions, and any misrepresentations and omissions you perceive.

In the end, are you at the mercy of the bankruptcy court?

You may want to litigate this in the bankruptcy court. Your claim can be recognized in whole or part, and the debt can be discharged, and you might object.

If you're a large creditor you may want to be on the creditors’ committee, to make decisions about the bankruptcy. You may recommend a chapter 7 liquidation rather than a chapter 11 reorganization, for example.

And…

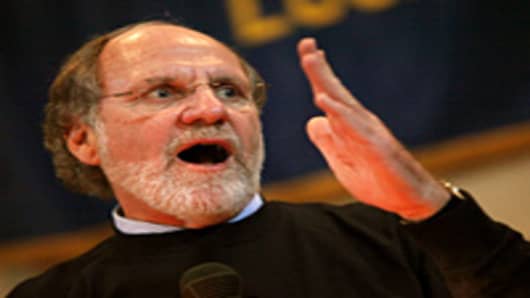

Jon Corzine has not filed for bankruptcy. Did he or other directors commit fraud? They are all going to get sued.