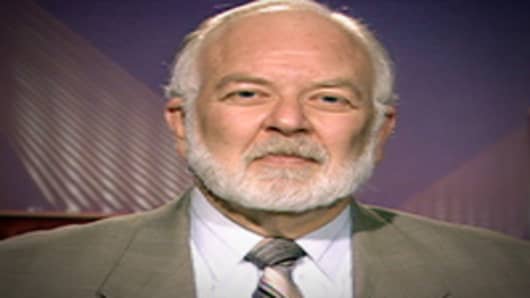

Even as bank stocks continue to fall, analyst Dick Bove says investors should keep buying despite the companies' extreme sensitivity to the events in Europe.

"If we look at what's happening now in the world today for banks, everything is moving in a positive direction," the Rochdale Securities analyst said in a CNBC interview. "I think you should be buying these stocks hand over fist. But I believed that when they were substantially higher than they are right now."

Indeed, as measured by the KBW Bank Index the industry is down 24 percent since the early July highs and 28 percent for the year. Financials in the Standard & Poor's 500 are off 22 percent year to date.

During the slide, Bove actually has increased exposure to equities in his personal portfolio, going from all cash in the summertime to 50 percent stocks now.

As he sees it, investors should be taking advantage of the turmoil in Europeto buy stocks, rather than selling at every indication that the sovereign debt crisis is spreading.

"On a fundamental basis, it's almost impossible to believe that these stocks are not dramatically underpriced," Bove said. "However, the market continues to freak out over every conceivable thing that they can come up with. No matter what it is, it's bad for the financial industry."

Because of regulatory restrictions, Bove cannot buy stocks he covers. However, he said if he could he would buy Bank of America , Morgan Stanley, State Street and US Bancorp.

He is not dissuaded that S&P has said 5 percent of bank stocks could receive a two-notch downgrade. Even if the ratings agency would take such an action against a major bank, Bove said it would mean "nothing" to their business

"Basically, these companies are right now experiencing enormous benefits as a result of the crisis that is occurring in Europe," he said.