Heading into Monday’s aggressive rally, the Standard & Poor’s 500 financials were off 26.3 percent on the year, and the KBW Bank Index had fallen 31 percent.

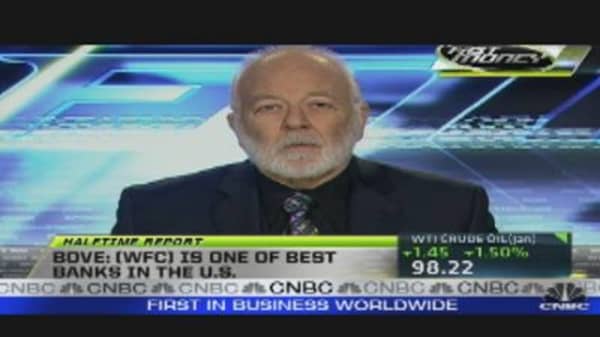

For Bove—Rochdale’s vice president of equity research—the decline has been a maddening ride spurred not by bank fundamentals but rather by investors’ belief that no matter how good the earnings look or how loans are performing or where capital levels stand, investor worry over bigger factors takes precedence.

“The macro factor will continue to be more important than the micro factors,” Bove conceded over the weekend in a moderate mea culpa to investors.

“On periods like this analysts, like me, who rely on traditional parameters like company results and historic relationships between interest rates and earnings yields, are going to have a tough time.”

In essence, Bove argues that he was wrong for the right reasons.

Liquidity, capital, loan performance, revenue, profits—all the metrics by which one would traditionally analyze banks—look good.

But worries over the world’s debt crises, particularly in Europe and the U.S., are making risk-averse investors unwilling to buy the banks in Bove’s coverage universe.

“The divergence between the economic and financial fundamentals, on the one hand, and the stock prices, on the other, reflects a change in risk assumptions,” he wrote.