With corporations taking public hits and with so many bad headlines crossing daily it’s easy to forget that there are plenty of chief executives keeping their heads down, growing companies and creating value for employees and shareholders.

Some, though, are doing it better than others, and so my Street Signs colleagues and I thought it would be fun to figure out who the best of the best in the c-suite were this year.

Thus, we created the first annual Street Signs ‘2011 Best CEO’ list (which is now being referred to on our team as the less-official sounding “Berbie” awards).

Four criteria were used to find the winners:

- Stock Performance: Shares must be up for the year and outpacing the broader market and most competitors

- Operational Performance: The CEOs must keep a clean balance sheet, with low debt levels, solid operating margins and growth in most financial metrics.

- Strategic Vision: Leaders were vetted for how well they saw and executed on the big picture, made smart deals and managed through a still difficult U.S. economy.

- Miscellaneous: The important intangibles such as time at the company, job creation, compensation, analyst commentary, thoughts from viewers and employees, etc.

We kept tightening the criteria on the first two screens until we were left with only about fifteen companies. A few of us then huddled up and hunkered down, using the final two criteria to narrow the list down to five and rank them.

To be fair, there are probably some names who deserved to be on our list, and some on this list who readers think do not deserve to be on it. And this list reflects mostly what these executives and their companies have done this year. To quote the standard investment disclaimer: "past performance is no guarantee of future results."

So that aside and without further ado, here’s my 1st Annual Best CEOs of 2011 list:

Number 5: Greg Henslee, O’Reilly Automotive.

There’s a lot of money to be made in car parts, and in shares of O’Reilly Auto lately.

Henslee began at the company way back in 1985. He has added nearly $50 to the stock over the past three years and it’s been hitting all-time highs most of this year—outperforming most of its rivals.

Back in January, Henslee set a program to add 170 stores to O’Reilly’s lineup and announced a $500m buyback. That was just the first of three buyback announcements this year.

Sales have jumped by more than $200 million this year, helped by a strong used car market and need for do it yourself repairs. Henslee’s annual pay is listed at $842,000, but Reuters pegs his total comp as just under $5 million.

Most analysts are positive on the name, though JPMorgan Chasehad to make one of the year’s worst calls when it downgraded the stock back in April. A true midwesterner, Henslee operates out of Missouri and keeps a low profile.

Correction: An earlier version of this story incorrectly reported Henslee's total compensation at just under $5 billion, when it is actually $5 million.

Fourth Best CEO of 2011

Number 4: Angel Martinez, Deckers Outdoor.

Martinez is the newest CEO in the group, having joined Deckers in 2005 after stints at Reebok, Keen, Rockport and Tupperware .

Martinez kept Deckers from being a one-hit wonder by making smart deals for hip brands such as Tsubo in 2008, and surfer-favorite sandal maker Sanuk this year.

The greatest feat Martinez has pulled off though is keeping the Ugg boot from becoming a fad gone bad. Though the brand is now 32 years old, Uggs remain hot—with the Wall Street Journal pegging the boot as a ‘must have’ this holiday season.

The stock has frustrated short sellers all year. Though off its high of $117, shares were under $20 less than three years ago. Two things Martinez must watch: Decker’s growing inventory levels and $45 million in new debt now on the books. Reuters says Martinez’ total compensation this year will be just over $5 million.

Third Best CEO of 2011

Number 3: Eric Wiseman, VF Corp..

The stock and operational performance of the company alone are enough to put Eric Wiseman near the top, but the June acquisition of Timberland finalized Wiseman’s spot on this list.

Rarely do analysts fawn over a deal as much as this one, and the Timberland buyout appears to already be paying dividends. Not deal shy, Wiseman also acquired the Rock & Republic brand this year and bought full ownership in a joint venture in India.

Though debt levels remain a little high for some investor tastes, VF has a few hundred million in cash on the books and a book value per share of more than $40 for the first time ever.

In October VF raised guidance again. Wiseman, 56, is well paid, with a total compensation listed as $9.3 million by Reuters.

Second Best CEO of 2011

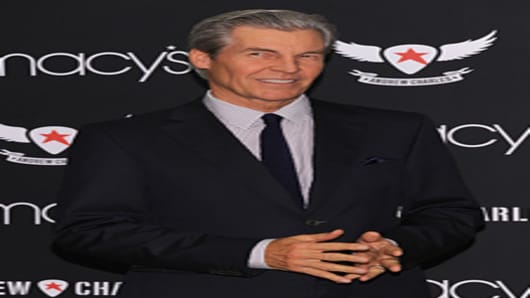

Number 2: Terry Lundgren, Macy’s.

Things were looking bleak for Macy’s and most department stores a few years ago. Many ‘smart’ retail pundits suggested department stores would go the way of the dodo or cassette deck. But Macy’s Terry Lundgren used the weakness of others to grow his company, snapping up other stores and capturing market share.

Macy’s now operates more than 800 stores along with its upscale Bloomingdale’s brand. That scale gives the company greater negotiating power with suppliers, using volume to press them for lower prices and increasing profits.

Earnings and net income are well up from a year ago. The company is also hiring around 78,000 workers for the holiday season, and some of those jobs should translate into full time employment. As with some of the others on this list, Lundgren needs to watch growing inventory levels. He’s the highest paid CEO on this list, with Reuters putting his total compensation at a sliver less than $15 million. He also holds more than one million exercisable stock options.

2011's Best CEO

Full disclosure: my wife works for a company that does business with Macy’s.

Number 1: Patrick Doyle, Domino’s Pizza.

It’s rare when a company’s marketing strategy is “we can do better,” but that’s exactly the refreshing tact Doyle and Domino’s Pizza took this year.

The honesty seems to have worked, as sales in the 3rd quarter rose handily. Gross margins are also up year over year, not an easy feat as consumers watch every penny and the pizza wars keep pushing prices down.

Domino’s shares have been as hot as a fresh slice, more than doubling this year and outpacing rivals such as Papa Johns . Sales, earnings and net income are all well up from last year.

Doyle is also making a big push outside of the U.S., with sales at international stores growing faster than stateside. He’s also reduced Domino’s total debt by more than $200 million since the end of 2007. Forbes ranked Domino’s as the #1 franchise bang for the buck earlier this year, citing low overhead costs and an expanded menu. The company also boasts a special school lunch program using sauce with lower sodium levels.

In May, billionaire investor Nelson Peltz reported a 9.7 percent stake in Domino’s. The solid results, shareholder gains and growth in one of the toughest retail markets makes Patrick Doyle my top CEO of 2011.

Questions? Comments? Email us at marketinsider@cnbc.com