Utility, material and industrial companies led the gains in the S&P 500 index on Wednesday, after the Federal Reserve announced it will keep interest rates near zero in the long-term.

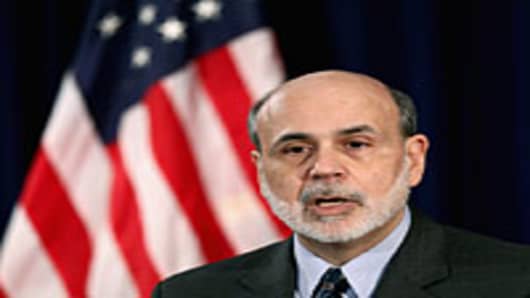

"The committee decided to keep the target range for the federal funds rate at zero to one four percent, " said Fed Chairman Ben Bernanke at a news conference.

"We currently anticipate that economic conditions are likely to warrant exceptionally low levels for the federal funds rate at least until late 2014."

Utility stocks traded higher after the announcement, as investors sought high-yielding assets.