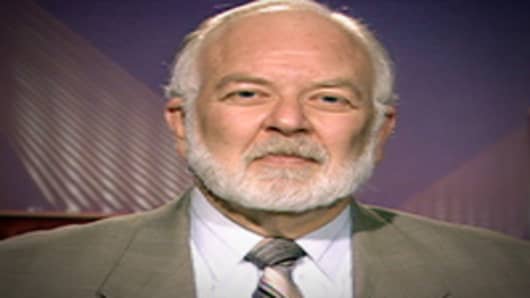

Between the Federal Reserve’s announcement that it will not raise interest rates until at least 2014 and President Obama’s mortgage refinancing plan, the government is trying to cripple the banking system, noted bank analyst Dick Bove told “The Kudlow Report” Wednesday.

“What this government is doing is its attempting to restrict or cripple the banking system so it cannot perform the way it wants in terms of assisting the economy,” the Rochdale Securities analyst said.

On Wednesday, the Fed said economic conditions “are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.”

But Bove believes keeping rates near zero percent “does not help the banks in any way, shape or form.”

“Interest rates are so low at the present time that any reduction in interest rates reduces the yield on assets without affecting the cost of liability,” he said.

And that, in essence, is squeezing the margins of the banks.

“If you want the banks to lend money, you have to allow them to make money,” he said. “And the government doesn’t want them to do that.”

He also had harsh words for President Obama’s State of the Union address Tuesday night.

In a research note released earlier Wednesday, Bove said, “The most absurd statement made in the State of the Union message last night was that the United States has passed laws that make another financial crisis impossible.”

He called that thinking “delusional,” pointing out to Kudlow that financial collapses occur on a regular basis throughout history and have nothing to do with the government. It’s about the way money is manipulated in an economy.

“For a government to stand up and say look, we can outlaw all of the rules related to economics, we can outlaw all of the rules related to finance by passing a few laws simply doesn’t make sense,” Bove said.

Reuters contributed to this report

Questions? Comments, send your emails to: lkudlow@kudlow.com