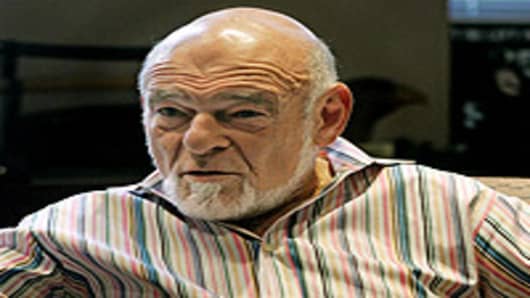

Government intervention has prevented the real estate market from healing, with the commercial sector hit especially hard, investor Sam Zell said.

As sales languish and prices continue to fall, the head of Equity Group Investments and numerous other ventures pinned the blame on policies that refused to allow market forces to take hold.

"Rather than let the elements of the business world take care of the problems, we basically stopped the process of creating market clearing," Zell said in a CNBC interview. "Had we allowed the market to clear without trying to stop reality...we would have a healthy housing market today."

Since the financial crisis began in 2008, Washington lawmakers and President Barack Obama have launched a counterattack against thehousing market'scollapse.

Most prominently, the administration implemented the Home Affordable Modification Program, aimed at helping as many as four million distressed homeowners refinance their mortgages at affordable terms. However, the program has reached only about one-fourth its original goal.

In his state of the union address, Obama pledged to expand the effortsto include even those buyers whose mortgages are not owned by government-sponsored enterprises Fannie Mae or Freddie Mac.

"It's putting off facing up to reality," Zell said in describing the efforts to halt foreclosures. "The longer we avoid clearing the longer we're going to be living with this problem."

Zell drew a distinction between the housing programs and the bailout efforts for big Wall Street financial institutions that he said were necessary to save the national economy.

"If our banking system didn't work, the calamity is almost immeasurable," he said. "So to try and equate coming in and in effect protecting the banking system with protecting the housing market is apples and oranges."

While the foreclosure robo-signing scandalis played out in the courts and the housing market languishes, Zell said banks should take action.

"The first thing I would do is I would encourage lenders to move forward and exercise their legal rights, literally — not so much to hurt anybody but to resolve the issues," he said. "Remember, we're different from any other country in the world. We are the only country in the world where you can borrow money on a house and walk away from it."

Zell said he likely won't be making any big investments in housing soon, as "execution" remains a problem when dealing with so many homes. Commercial real estate, meanwhile, remains problematic as well.

During the downturn in the early 1990s, Zell said he advised "stay alive until '95." Now, his mantra is "come clean by '13."

"Commercial real estate still has another couple years to get its act together," he said. "That's literally the point at which all of these extensions and other stuff get cleared out. Because otherwise you're going to have a commercial real estate market that doesn't work."