I know, I know, you're all obsessed with the ECB and the 3-year LTRO that they are going to announce tomorrow. Lots of cheap money for European banks.

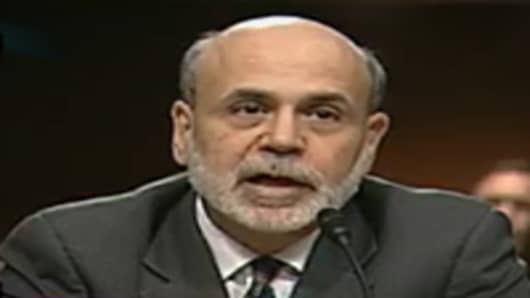

Let me change the topic. Ben Bernanke's testimony in the House tomorrow.

Fed's Operation Twist ending on or near June 30th; traders expecting more volatility. I've been asked why the CBOE Volatility Index (VIX) is so low for the spot price (18), but climbs to 25 by April and almost 30 by the end of the summer.

One answer: the Fed is expected to end Operation Twist at the end of June. Historically, market volatility picks up after the Fed has exited the markets. In Operation Twist, the Fed has extended the average maturity of the Fed's portfolio of Treasuries, a way of keeping rates low without printing more money and expanding the Fed's balance sheet.

Bernanke will be peppered with questions about the end of Operation Twist and asked about the prospects of QE3. It's not that I'm expecting any new policy to be announced (he wouldn't do it in this forum). But just his posture on the economy may indicate the Fed is existing the liquidity business for good...or not.

Another reason volatility is higher going out a few months: the presidential election.

One other factor affecting volatility farther out: the higher cost of supplying insurance. Think about this: banks provide money to buy puts and calls on the S&P 500, and everything else. But capital is dear now: for a bank to sell an option a year from now is more expensive for a bank than to sell an option a month from now. In a sense, that has always been true, but there is less capital to go around, because banks are stressed.

_____________________________

Bookmark CNBC Data Pages:

_____________________________

Want updates whenever a Trader Talk blog is filed? Follow me on Twitter: twitter.com/BobPisani.

Questions? Comments? tradertalk@cnbc.com