Four months into a stock market rally, and Americans are still going for gold.

More so than real estate or even stocks, investors call gold the "best investment” according to CNBC’s latest All-America Economic Survey .

The precious metal has mass appeal. It is the preferred investment not only across income levels, but geographic regions, and even political affiliations.??

"Gold has taken over perceptions across the public as being a good investment. If not first, gold comes in as a very close second among investors," said pollster Jay Campbell of Hart Research, which conducts the quarterly survey for CNBC. Overall, 37 percent of respondents said gold is the "best investment," with real estate at 24 percent and stocks coming in third at 19 percent.

The attraction, say gold bulls, is the notion that the inherent value in a physical asset of limited supply can protect you from long-term inflation and economic uncertainty. Indeed, the survey shows that preference for gold rises as perceptions about the economy decrease.

Among people who say the economy will get worse in the next year, 50 percent say gold is the best investment, compared with 32 percent who expect the economy to stay the same. Suggesting inflation concerns, 82 percent of Americans surveyed think the cost of everyday goods and services will increase over the next 12 months.

These worries reach all corners of the nation. Americans from the Northeast, Midwest and South all report gold as their number one choice, while those in the West put bullion as second to real estate by only 1 percent.

Gold bugs — those bullish on the metal — are also found in every political group, though there is a telling split between right and left: 43 percent of both Republicans and tea-party supporters think gold is best, versus 32 and 33 percent of Independents and Democrats, respectively. For them, all other asset classes, including stocks, bonds, cash and real estate trail behind the precious metal.

But perhaps most striking is gold's appeal to Americans of all income levels. Thirty-nine percent of earners making between $30k and $50k per year say gold is best, compared with 42 percent of those making more than $100k.

Campbell thinks good marketing is one explanation for gold's favor. "It goes to show you what marketing can do," he said.

Since the launch of the exchange traded fund SPDR Gold Shares in 2004, promoted by the World Gold Council, gold no longer needs a treasure map.

Every day, about $2.1 billion worth of gold is traded via the GLD fund, which has ballooned to a $69.5 billion behemoth in less than eight years.

"What GLD has done has brought in new people who previously didn't invest in gold, being more equity oriented. Now they can buy ETFs easily,” said Jeffrey Christian, managing director of the CPM Group.

Despite gold’s success, Christian sounds a note of caution. “We think the gold price passed its cyclical peak. It’s had a very good run over last 11 years and may now be in subsidence.”

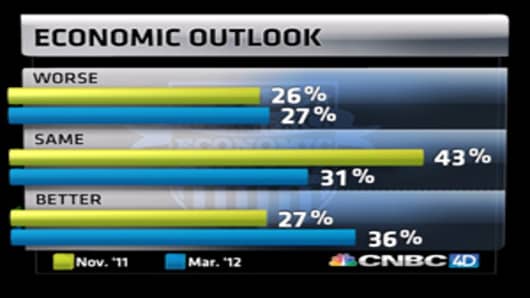

If gold is a fear-based, ‘apocalypse trade,' then Christian may be on to something. Though the economy is nowhere near full recovery, recent indicators such as employment , consumer spending and corporate profitability have all been stronger than expected.

The conundrum is that while gold may have peaked, the Americans surveyed don’t see a ready substitute. Forty-nine percent of respondents said that now is either a “very bad” or “somewhat bad” time to invest in the stock market. While this is slightly improved from last quarter's 53 percent, it is up from this quarter last year, when only 46 percent said it was a bad time to invest.

These perceptions do not reflect how the market has moved from last year, when the Dow Jones Industrial Average was under 12,000 to current levels well over 13,000. That said, institutional investors — not small players — are driving this market. “Retail investors in general have not participated in this rally. They represent a very small portion of it,” noted Hart Research's Campbell.

The question is, will they come on board now? It wouldn’t be the first time retail investors showed up late to the party — think 2007. For now, a negative attitude toward stocks, rational or not, is feeding gold bugs' bullishness.