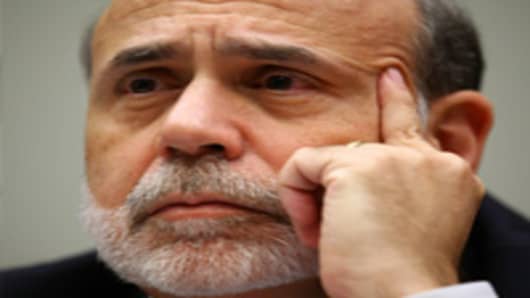

Although the U.S. economy has shown signs of improvement recently, Federal Reserve Chairman Ben Bernanke cautioned that high gas prices could lead to a "hit on growth" and rising inflation.

"But at this level we don't think yet that — particularly given the other good news we've seen in labor markets and so on — we don't think it's going to be anything that's going to stall the recovery," said Bernanke in an ABC News interview on Tuesday.

Bernanke added that the nation's 8.3-percent unemployment rate remains "too high" and that it is "far too early to declare victory" on an economic recovery.

Getting the housing market back on track and adding additional jobs for the long-term unemployed remain challenges for the economic recovery, he said.

About 40 percent of out-of-work Americans have been unemployed for longer than six months.

"Those people are obviously facing a lot of hardship," he said.

Bernanke's remarks came a day after he surprised marketsby saying the labor market remains weak and that the Fed could still do more easing if needed.

While not a departure from his previous comments, traders took Bernanke's speech to mean that Fed action is still a strong possibility.

Markets had been calculating reduced chances for a third round of quantitative easing after Bernanke's less dovish comments in congressional testimony earlier this month. The Fed’s post-meeting statement March 13 also gave a nod to an improving economy without expanding on further easing.

But Bernanke's comments this week, including the ABC interview, reinforced speculation that the Fed was prepared to step back in if needed to boost growth.