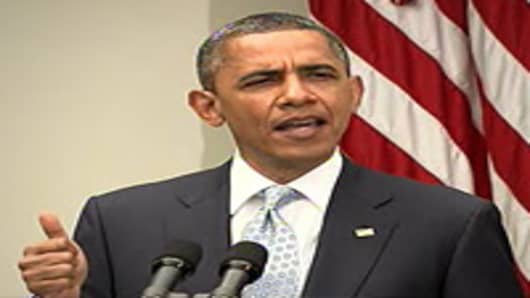

President Obama, under pressure from rising gasoline prices, unveiled a $52 million program Tuesday to strengthen federal supervision of oil markets, increase penalties for market manipulation and empower regulators to increase the amount of money energy traders are required to put behind their transactions.

The plan is more likely to draw sharp election-year distinctions with Republicans than have an immediate effect on prices at the pump. The measures seek to boost spending for Wall Street enforcement at a time when congressional Republicans are seeking to limit the reach of federal financial regulations.

Republicans also have been hammering Obama on his energy policies, recognizing the political cost of high gas prices on the president.

Obama's plan would turn the tables on Republicans by taking aim at Wall Street's role in the oil price chain. The proposal aims to detect and deter illegal manipulation by energy speculators, the type of practices that many Democrats blame for the high cost of gasoline.

At issue is the increasing role of investment in oil futures contracts by pension funds, mutual funds, hedge funds, exchange traded funds and other investors. Much of that money is betting that oil prices will rise. Analysts say it is possible that such speculation has somewhat inflated the price of oil.

At the same time, investors can also bet that prices will go down — indeed, speculators have been credited for low natural gas prices.

Studies of the effects of speculation on oil markets indicate that it probably increases volatility, but doesn't have a major effect on average prices.

Still, seeing a potential problem with speculators is not limited to Obama or Democrats or this election season. When gasoline hit $3 a gallon in 2006, George W. Bush launched an investigation, declaring Americans "don't want and will not accept ... manipulation of the market. And neither will I."

Last year, as prices rose, Obama and Holder announced the creation of a task force to look into fraud in the energy markets. Obama's plan this time calls on Congress to:

1) Increase six-fold the surveillance and enforcement staff of the Commodity Futures Trading Commission to better deter oil market manipulation.

2) Increase spending on technology to provide better oversight and surveillance of energy markets.

3) Increase civil and criminal penalties against firms that engage in market manipulation from $1 million to $10 million.

4) Give the Commodity Futures Trading Commission authority to increase the amount of money that a trader must put up to back a trading position. The administration officials said such authority could help limit disruptions in energy markets.

The White House effort comes at the same time that Republicans have been pushing Obama with their own energy proposals. House Speaker John Boehner (R-Ohio), wants to seek votes on more domestic oil and natural gas exploration, a freeze on regulations on refineries and approval of construction of the Keystone XL pipeline from Canada to Texas, a project Obama has blocked.

Republicans are also trying to place limits on the financial regulation legislation Congress passed in 2010 over Republican objections. Though the House Republican budget, which calls for sharp reductions in government programs, does not specify reduction in spending by the trading commission, the administration officials said that if the cuts were applied the commission would lose more than five times what it spends on regulating energy markets.

The debate will pit Republicans who blame Obama for high gasoline prices against a White House that blames Republicans for coddling Wall Street.

CORRECTION: This version corrected the amount of the Obama plan to $52 million, not $52 billion.