Viennese commuters may be well used to the sight of a short but athletic Middle Eastern man out on his brisk morning jog, pursued by a posse of reporters hanging on his every word.

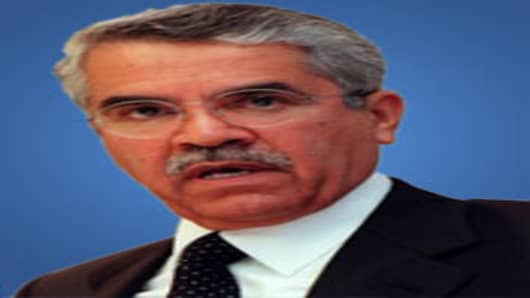

That man is Ali al-Naimi, 77, Saudi Arabia’s highly influential oil minister. His comments during his regular speed walk -- one of the more unique highlights of the Organization of Petroleum Exporting Countries’ regular ministerial gatherings in the Austrian capital -- often provide valuable insight into the mindset of what some describe as the ‘Central Banker of Oil’.

Seasoned OPEC watchers will be looking for further clarity from him during OPEC’s Thursday meeting since his latest views on production policy have been somewhat vague.

Markets will be hoping moderate voices -- like Saudi Arabia’s -- to prevail amid calls from some OPEC members for production cuts.

Make no mistake, Saudi Arabia is a ‘swing producer’ with the spare capacity to move markets and that makes Al-Naimi a powerful player.

“Ali al-Naimi pretty much controls the world’s oil tap,” Lynn Westfall, Chief Economist at Tesoro, a large U.S. oil refiner, wrote in a 2008 profile for ‘Time’ magazine’s Top 100 list of the world’s most influential people. “Saudi Arabia has the biggest bat, and the Saudis have shown that they will use it to bring the others in line.”

The tone of Thursday’s OPEC meeting may be tense. Saudi Arabia put itself on a collision course with fellow OPEC member countries on Monday by calling for an increase in the group's output target despite a recent fall in crude prices, Reuters reported.

“Our analysis suggests that we will need a higher ceiling than currently exists,” Saudi Oil Minister Ali al-Naimi said in an interview with the Gulf Oil Review ahead of the meeting. That was at odds with the assessment by OPEC's Iraqi President, Abdul Kareem Luaibi, that there is a surplus in oil from the 12-member group, Reuters said.

Oil markets fell on those comments on Monday and ANZ Research said U.S. crude futures “could see prices test support just below $80 a barrel in the near term.”

Tom Essaye, President at Kinsale Tradingbelieves Al-Naimi’s comment “certainly isn’t bullish” though it’s possible the market may discount the remarks “since it’s widely known that OPEC members produce more than their quota anyway.”

Al-Naimi, however, claimed he was misquoted and clarified his position to reporters after arriving in Vienna. “That is not what I said,” he said. “I said, maybe. And maybe it'll be lower.”

Clearly, the most influential member of OPEC is playing his cards close to his chest and doesn’t want to see a disorderly price spike or a price collapse. A stable oil price is vital for policymakers in the region to ensure enough social spending in their budgets to head-off the Arab Spring-type uprisings seen last year and Syria’s near state of civil war now.

Al-Naimi last month said that he aims to get the price of Brent crude down to $100 a barrel, marking a shift from his prior position of largely avoiding comment on price targets. July Brent crude on Wednesday settled at $97.13 a barrel in London, just a cent lower but its fifth consecutive drop and marking a fresh 16-month low, Reuters reported. Brent has fallen 24 percent from its year high of $128.40 hit in March.

“$100 a barrel for Brent is pretty much the floor,” Fereidun Fesharaki, Chairman & CEO at consultancy Facts Global Energy and a former energy adviser to the prime minister of Iran during the 1970s. That’s “the number the Saudis are looking for and the number the market is looking for.”

To be sure, Saudi Arabia remains the chief moderate voice within OPEC and will remain committed to keeping global oil markets well supplied.

The Kingdom certainly doesn’t want to see prices spike higher, jeopardizing the fragile economic recovery, which is why the top oil exporter has boosted output to around 10 million barrels a day (b/d), the highest level in decades.

“The Saudis will prefer to err on the side of keeping the market well-supplied as Iranian output drops with U.S. and EU sanctions taking full effect at the end of June,” said Greg Priddy, Director, Global Oil at Eurasia Group.

“With demand bottoming out and Iran sanctions still representing a major near-term supply risk, Saudi Arabia will probably continue to produce at its current 10 million b/d over the summer, and there will be no ‘headline’ cut at the 14 June OPEC meeting in Vienna,” Priddy added.

OPEC Pumps More

Crude oil production from OPEC rose 40,000 barrels per day to 31.75 million in May, a Platts survey of OPEC and oil industry officials and analysts showed June 8. The May production marks a rise from April’s output level of 31.71 million b/d and is the highest level since October 2008 when OPEC volumes averaged 32.26 million b/d.

An increase in the January to May period to 31.75 million b/d last month from 30.87 million b/d in January “occurred even as Iranian supplies were being squeezed by a drop in the number of customers willing to take its oil,” said John Kingston, Platts global director of news.

“We can now assume OPEC members at least will discuss at their upcoming meeting a possible paring of production,” Kingston said. “This scenario was almost impossible to fathom just a few months ago, as OPEC continues to surprise the world with its ability to put oil on to the market.”

The output increases that totaled 150,000 b/d from Saudi Arabia, Kuwait and Libya more than offset declines that totaled 110,000 b/d from Angola, Iran, Iraq, Nigeria and the United Arab Emirates. Iranian output was 3.25 million b/d in May, down from 3.28 million b/d in April, the Platts’ survey showed.

“Most believe that OPEC will try to reign in over-production yet it is clear that the Saudis will do what is best for them,” said Phil Flynn, an analyst at Price Futures Group in Chicago. “The Saudis are also worried about the impact that high prices may have on the viability of the cartel. With production rising in North America, the Saudis don’t want to risk losing any more customers.”

In a preview of the OPEC meeting, Deutsche Bank analysts Xiao Fu and Michael Hsueh said OPEC will likely reiterate its concern that Europe remains the central risk to global growth, posing significant downside risks to the oil price.

“In Brent terms, oil prices are slowly moving towards the level which triggers strains on fiscal positions,” they said. “For the Gulf region as a whole, we estimate break-even oil prices are around $87/barrel (Brent equivalent). Consequently, we are moving towards an environment where OPEC will intervene to defend the oil price.”

Ahead of the OPEC decision the International Energy Agency will release its Oil Market Report on Wednesday. Strategists say there’s a risk the IEA will further downgrade its oil demand outlook.

“According to the last IEA OMR report, global oil demand for 2012 is forecast at just under 90 million barrels a day,” Deutsche Bank said.

“Given the recent batch of weaker U.S., China and Euroland real economy data, it appears increasingly likely that the IEA will revise lower its global oil demand estimates.” That could further embolden the hawks within OPEC to push for production cuts, undermining the Saudi position.

By CNBC's Sri Jegarajah