With two weeks left before the end of the first half of 2012, will stocks manage to hold on to their gains?

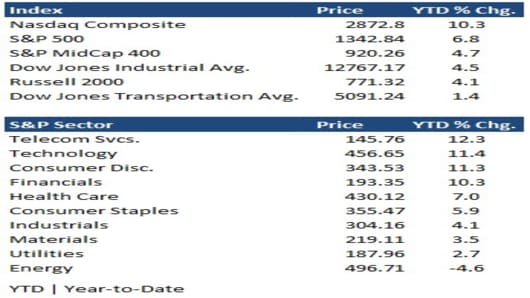

Despite a volatile second quarter, the major averages are still higher for the year thanks to the gains in the first quarter.

Similarly, while just three of the 10 S&P 500 sectors are up this quarter (telecom, utilities and consumer staples), nine sectors continue to trade in positive territory for the year (Energy is the only sector down).

Historically, when the S&P 500 has ended the first half with a gain, it has ended up on the year a staggering 93 percent of the time.