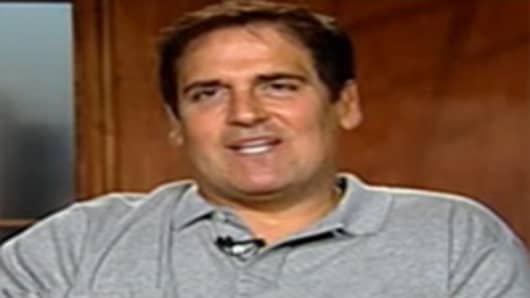

"I mean if you look at other companies like LinkedIn , they issued 8.4 million shares and the stock skyrocketed. If Facebook would have come out with 8.4 million shares, instead of 421 million, the stock would be at about $200 right now. So it was just the circumstances that led to me getting in and out," Cuban said.

Although Facebook has only traded as a public company for one month, it has had its fair share of issues. Along with a botched IPOand shareholder lawsuits, the company has also faced increased criticism of how it plans to monetize its mobile platform.

Cuban, who co-founded and sold start ups like Broadcast.com and MicroSolutions, acknowledged that the mobile space is huge, but it's an issue every Internet company will have to deal with.

"It's not just Facebook, like some people are trying to make it sound, it's Google , how do they get out ads? It's Zynga, it's everybody dealing with the same issues," Cuban said. "I think you will see an increase of monetization on the mobile level. But if Facebook can't do it, everybody else has the same risk and the same problem."

email: tech@cnbc.com