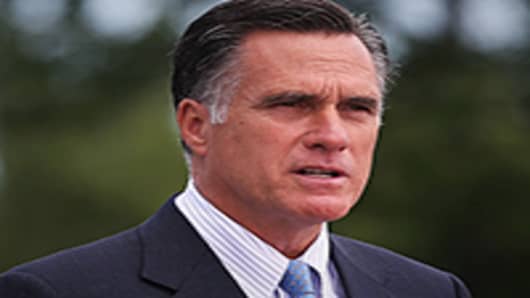

Most private equity investments are in profitable, growing midsized companies seeking help to expand to the next level. In fact, contrary to recent media stories, very few PE deals are turnarounds or restructurings. The private equity industry is misunderstood, especially regarding middle-market companies that comprise most PE activity. And with the election cycle in full swing, private equity has taken a spotlight based on Mitt Romney’s past at Bain Capital. Unfortunately, the largely misunderstood private equity industry has been turned into campaign rhetoric. I would like to address some common misperceptions about the PE industry:

Misperception 1: PE firms acquire troubled companies and do turnarounds and restructurings that result in massive job losses.

While a relatively small number of PE firms specialize in turnarounds, the vast majority focus on acquiring profitable growing middle market companies that are leaders in their respective industries. The entrepreneurs/owners and management typically stay with the companies after being acquired to partner with the PE firm to continue to grow the business. Most portfolio companies significantly add jobs after being acquired by a PE firm.

Many research studies support this. For example, GrowthEconomy.org is a major new project with research data from 1995-2009 that show middle market companies backed by private-capital significantly outperformed other companies on sales and job growth.

Misperception 2: PE firms load up their portfolio companies with debt and make most of their return on dividend recapitalizations that lead to bankruptcy.

First of all, turnarounds and restructurings are misunderstood. A company may need to be restructured to survive, and this may result in a company with say 500 employees letting go 200 people to save the 300 other jobs. In such situations, the initial investment is often 100 percent equity. Sometimes a company like this will fail, and the PE firm will lose its initial investment. Other times, after several years, the company is successfully turned around, and the PE firm may do a refinancing to add debt and pay a dividend to the investors. This is similar to a person buying a house that needs repairs for little or no debt, fixing it up, and then refinancing with a mortgage based on the new higher valuation of the home and the homeowner receiving cash at closing of the refinancing. Most PE firms, however, acquire well- managed profitable companies to help them continue to grow.

Misperception 3: The main goal of a PE firm is to maximize its return to its investors; therefore, PE firms do not care about employees or the communities in which they invest.

It is true that all PE firms are in business to try to maximize the return for their limited partners; primarily investors such as government and teacher pensions, college endowments, insurance companies and other institutional investors. However, in order to increase returns to investors, the PE firms must successfully grow their portfolio companies and increase sales and profits. This means keeping employees happy and adding jobs, providing quality products that meet customer needs, investing in R&D and new product development, building strong relationships with suppliers, investing in additional working capital and equipment to support growth, and being good corporate citizens in the towns in which the portfolio companies are located. Without successfully managing all these "stakeholder" relationships, a company will not grow and will not increase in value. Most PE firms improve their portfolio companies and position them for continued growth for many years after the PE firm exits the investment.

The recession and downturn starting in 2008 have distorted this somewhat because many PE firms needed to temporarily downsize some of their portfolio companies to survive the severe recession, and this did lead to some job losses. For example, at the end of 2008 several of our companies had a drop in sales of 25 percent to 30 percent in one quarter. If they did not make the necessary cuts to match the drop in sales, they would have gone under. Now these businesses are back on track and growing again, with many of the laid off workers hired back.

Misperception 4: PE firms are just financial engineers that do not add value and strip value out of portfolio companies before they exit.

Some PE firms have done this. However, the vast majority focus on adding value to their portfolio companies over time to improve the businesses. This includes many positive things PE firms do to help their portfolio companies, such as encouraging best practices in all functional areas, improving operations, implementing lean manufacturing, providing access to capital for working capital and capital equipment, helping with international expansion, assisting with smaller add-on acquisitions and joint ventures. These are not turnarounds; they help great mid-sized companies to do even better and expand to the next level. The whole process is very positive.

Misperception 5: PE firms are secretive and opaque; therefore, they must have something to hide.

Many PE firms are successful in growing and improving their portfolio companies, but few talk about it. Other than keeping their limited partners informed about their activities and the performance of the portfolio companies, there really has not been a need for PE firms to spend much time informing the public or the media about what they do. I and other PE industry leaders and associations need to do a better job communicating what we do, especially during this current political cycle where the Romney candidacy has made the PE industry a campaign issue.

Misperception 6: PE firms expand overseas to move jobs abroad and outsource.

During the 1990s, many large and mid-sized firms moved sourcing or manufacturing overseas to lower the costs of products for the U.S. market. Today, many if not most PE firms are helping their portfolio companies expand overseas to follow their U.S. customers to those markets or to sell products in those markets. Sometimes it is necessary to set up local manufacturing to serve international markets. When products are exported, the portfolio company may need to build significant sales, marketing, distribution, technical support and service organizations in those markets. These jobs clearly do not take jobs away from the U.S., but actually lead to more U.S. manufacturing jobs.

Private equity firms are investing in companies everywhere, supporting local businesses and helping to grow local communities. PE firms, especially middle market PE firms, invest in companies on Main Street and have a track record of helping good companies grow even faster.

John W. "Jay" Jordan II is Chairman and Managing Principal of The Jordan Company, LP, a private equity firm.