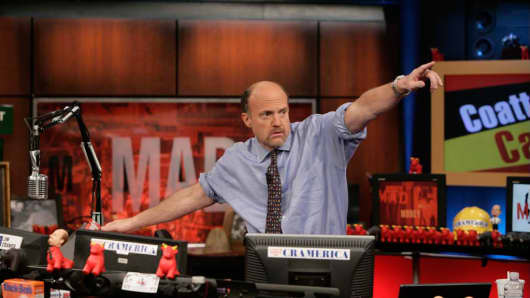

Apple’s recent big-dollar decline is hardly a cause for concern, “Mad Money” host Jim Cramer said Wednesday.

The company declined, closing more than 4 percent down at $573.97 per share.

“But don’t let the big numbers fool you,” Cramer said. “I find that if you divide everything by 10, things become a lot clearer. If Apple were a $60 stock, not a $600 one, and it fell $3, you wouldn’t freak out, particularly after what was, indeed, a serious disappointment.”

Cramer said that the stock was basically “dinged.”

So why not sell?

Part of the reason is valuation.

(Related: Cramer: Now Is the Time to Buy Apple)

Apple, Cramer noted, is selling for less than 11 times next year’s earnings.

“It’s among the cheapest stocks I follow, offering phenomenal growth for a price rather similar to many cyclical semiconductor names,” he said. “It is much, much cheaper than any packaged-goods stock I follow, yet the food and household products companies grow very slowly and many have become inconsistent in their earnings reports.”

To be sure, there were real concerns raised in the company’s conference call, he added.

“Given that Apple gets about 24 percent of its business from Europe, and it sells expensive devices, you’re going to see a continued slowdown, and we don’t know how much of the reduced guidance is being caused by Europe’s woes,” he said.

Another factor to consider is Samsung, which makes chips for the iPhone and is also marketing an Android phone that could give Apple a run for its money.

Also, companies such as AT&T, Sprint and Verizon might not necessarily continue to subsidize Apple’s smartphones.

But Cramer urged a look at the bigger picture.

(Related: Broadcom CEO Touts New Battery-Saving Chip)

“We now have guidance that is so reduced, I have a hard time believing it can’t be beaten,” he said, adding that the iPhone 5 could be such a major upgrade that existing iPhone users are waiting to upgrade.

“One of the remarkable hallmarks of Apple is that new iterations tend to be worth waiting for,” Cramer added.

Finally, he pointed out, it’s not as if Apple is just a phone maker.

PCs and the iPad are still growing and look to be cheaper. A new Apple TV, possibly even with Siri’s voice recognition, might be coming soon.

If it were a $57 stock, the question would be a no-brainer, Cramer said.

“I reiterate that I believe Apple must be owned. You don’t rent it and you don’t trade it,” he added. “I think it will be well worth it as it has been for all the years and years that I’ve told you to hold on to the best manufacturer, the best retailer, and the best technology stock money can buy.”

@MadMoneyOnCNBC on Twitter

"Mad Money" on Facebook

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com