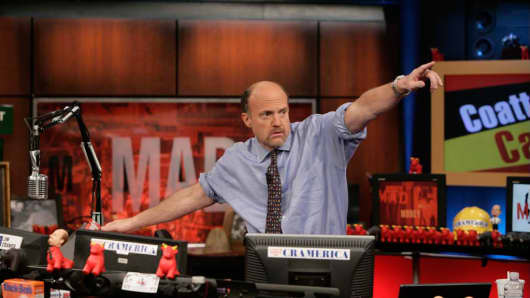

Three old-school biotech stocks on Friday showed why they’re good picks for the long haul, “Mad Money” host Jim Cramer said.

Gilead, Amgen and Celgene all saw their stock prices climb “because it shows you that these forward-looking companies are still trying to grow. They aren’t just sitting there, facing patent cliffs and hoping to hold on before taking a real beating,” Cramer said.

Cramer noted that for some companies, like Merck, it’s something of a waiting game before the effect of new drug products kick in.

“Other outfits, like Abbott Labs and Covidien, two terrific companies, are breaking into pieces to bring out value,” he added. “Johnson & Johnson could easily adopt a similar breaking up is easy to do strategy and create a gigantic spike for patient investors now that a new CEO is in place.”

But Cramer’s favorite aspect of owning pharma stocks is growth.

“Amgen, which soared $4.63 cents today to finish at a 52-week high of $83.92, is talking about some breakthrough products that can attack gastric tumors and ovarian cancer, as well as anti bad cholesterol statins that can work in cases where all others have failed,” he said.

It’s older drugs, like Epogen and Enbrel, are still performing well.

(Related: Cramer Chats with Covidien’s CEO)

“Gilead’s got a terrific Hepatitis C franchise that could potentially be worth billions and billions of dollars starting in 2014,” he said.

The company’s pricey purchase of Pharmasset, which has a top-notch Hepatitis C drug, didn’t drag on its earnings.

What about Celgene?

Cramer said the stock was prematurely written off when the company ran into a snag with its European application for the extended use of Revlimid.

(Related: Cramer: 5 Stocks Staging a Comeback)

“But I’m confident the franchise remains intact, and the number of initiatives Celgene has in the pipeline could lead to multiple years of earnings upside,” he said.