Sound corporate earnings, cheap valuations and Russia’s entry into the World Trade Organization make the country's equity market stand out among its emerging-market peers, fund mangers say.

Russian stocks, for example, are the cheapest among the equity markets of the BRICcountries – Brazil, Russia, India and China.

Brazil, India and China trade at about 11 times, 15 times and 9 times forward earnings respectively, while Russian shares trade at just 4 times. U.S. fund manager BlackRock, for one, thinks that this makes Russian equities a good buy.

“Those types of valuations are indicative of markets like Pakistan. Actually it’s cheaper,” Russ Koesterich, Global Chief Investment Strategist for BlackRock iShares, told CNBC Asia’s “Squawk Box” on Wednesday.

“While there is no lack of issues surrounding Russia, it is very hard to argue that those are not already reflected in the price,” he added.

Russia’s entry into the WTO, expected on Wednesday, strengthens the long-term case for Russian equities, Koesterich said.

Russian shares have put in a decent performance so far this year, with the main Micex Index gaining about 6.7 percent. This compares with Indian equities, which have climbed 15.5 percent and Brazilian shares, which have risen 3.8 percent. Chinese equities , on the other hand, have fallen 4 percent.

Companies on the main index have stayed “remarkably profitable” as well, Koesterich said, adding that the return-on-equity for the main Russian index is 21 percent.

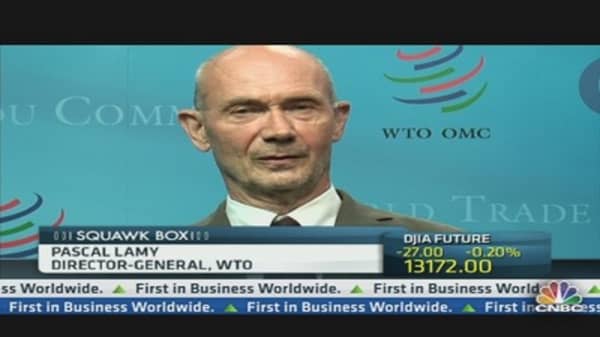

The accession of Russia into the WTO could further boost opportunities for foreign investors, as they would start perceiving the country as less risky, said WTO Director General Pascal Lamy in an interview with CNBC on Tuesday. Higher investments will follow Russia’s entry to the WTO but it will take time, Lamy said.

“The experience with previous accessions, whether it’s China, Saudi Arabia, Vietnam, Cambodia, Ukraine in recent years, shows that it’s not a Big Bang effect,” Lamy said. “It takes time, but the most immediate consequence you usually see is on the investment side. Joining the WTO for a country is sort of getting a quality label which investors worldwide usually see as a reduction in risk premium.”

Russia’s $1.9 trillion economy is the world’s ninth-largest and it has among the world’s biggest natural gas and oil reserves. U.S. companies have been stepping up efforts to access that market, with key business group National Foreign Trade Council saying it will press Congress to approve so-called "permanent normal trade relations" with Russia.

Indeed, billionaire investor Jim Rogers said he is starting to look at Russia in a new light especially after President Vladimir Putin’s recent vow to make Russia friendlier to foreign investors. Putin vowed when he assumed office in June that he would increase investment from its current level of 20 percent of GDP to 27 percent by 2018.

“I had been a huge skeptic of Russia since it broke up, since the Soviet Union broke up,” Rogers told CNBC Asia’s “Squawk Box” on Wednesday. “I’m starting, to my own astonishment, to question my own views on Russia and looking more favorably on Russia. I am not an investor there yet, but I am starting to consider it for the first time in my life.”

BlackRock’s Koesterich however warned that Russia is not for everyone and that uncertainty may continue for some time.

“It is by no means easy money, “he said. “I think you have to expect a rocky ride and a lot of volatility. But for investors willing to weather some risk, this is a really interesting opportunity.”

- By CNBC's Jean Chua.