It’s that time of year again! Class lists are posted, and school buses are loading. Could you profit from back to school trends?

Below is a look at retailers that have fared well so far this month, and which stocks could be poised to make money for investors based on historic trends.

As summer draws to a close, parents hit the stores and the web to refill backpacks and closets with fresh school supplies and new clothing for the academic year. There are a lot of choices for consumers and subsequently, investors.

Retailers reported August same store sales on Thursday, or comparable year-over-year sales for locations open at least a year. It’s the first glimpse the Street gets of how, and where, U.S. consumers are spending their back-to-school dollars.

While it’s not required of publicly traded retailers, many choose to self-report comp store sales on a monthly basis. Thomson Reuters tracks 22 of them and by and large, the results are better than Wall Street expected.

Macy’s, for example, reported August same store sales are up 5.1 percent year over year, bettering expectations, and Gap posted a 9 percent increase in comp store sales, beating the street by a wide margin.

The market seems to have picked up on sales strength at Gap and Macy’s throughout the month, with shares of both companies up 19 percent and 13 percent, respectively in August.

While not traditionally viewed as a back-to-school retailer, Nordstrom's same store sales were up 21 percent in August, helped by its Anniversary Sale event. Shares of Nordstrom have gained more than 8 percent this month.

If you’re looking to invest in retail in September and Q4, the trend seems to be stay away from American Eagle and Amazon in September, and consider Amazon and Dillardsafter September.

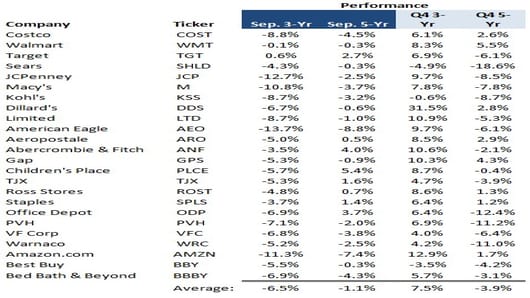

The statistics below include the performance for a group of retail stocks in the month of September, and in Q4.

These numbers include the 3-year and 5-year average (the 3-year avg. excludes 2008, which could be considered an outlier).

- AEO and AMZN appear among the worst performing stocks in Sep. for the 3 and 5-yr averages

- AMZN and DDS come up as the best performing stocks in Q4 for the past 3-years

Other Stocks to Consider

September performance:

- 3-Year average for the group: -6.5%

- Only one stock managed a gain in the last 3-years: Target, up +0.6%

- Worst performers: AEO, JCP, AMZN, M, with a loss greater than -10%

- 5-Year average for the group: -1.1%

- Best performing: PLCE and ANF, up more than +4%

- Worst performers: AEO and AMZN, down more than -7%

Q4 performance:

- 3-Year average for the group: +7.5%

- Best performing: DDS and AMZN, up more than +12%

- Worst performing: Only 3, SHLD, BBY and KSS

- 5-Year average for the group: -3.9%

- Best performing: WMT and GPS, up more than +4%

- Worst performing: ODP and SHLD, down more than -12%