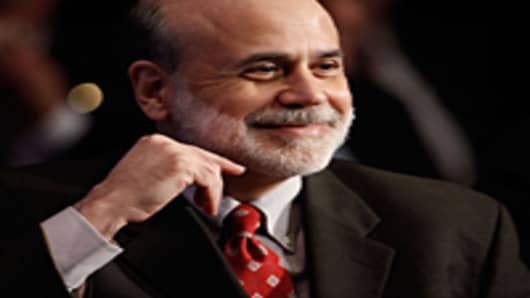

Ben Bernanke did it again.

The Chairman of the U.S. Federal Reserve announced plans for another aggressive stimulus program on Thursday, saying the central bank will buy $40 billion of mortgage-backed debt per month until the U.S. job market improves substantially.

(Related: Read The Federal Reserve Statement Here.)

In the wake of the Fed's announcement, stocks finished at multi-year highs. The Dow Jones Industrial Average surged 206.51 points, or 1.55 percent, to close at 13,539.86, with all 30 components posting gains. The S&P 500 rallied 23.43 points, or 1.63 percent, to end at 1,459.99, logging its best close since December 2007. The Nasdaq jumped 41.52 points, or 1.33 percent, to finish at 3,155.83.