Less than 10 years ago, Bollywood was largely an industry confined to India. Today it has gone global.

The Indian diaspora in the U.S. and other countries has opened up new potential markets for studios — and the films' unique approach to storytelling has made them a pop culture touchstone.

Typically, this widespread awareness would signal an investment opportunity for traders, but some people within the industry are urging caution.

"I believe the idea of Bollywood is a little bigger than its product," said Shekhar Kapur, an acclaimed Indian film director and producer, who also directed Elizabeth and The Golden Age, starring Cate Blanchett.

"Things have really grown because of the expansion of the diaspora market. … What everyone wanted to do was crack the U.S. and European markets — and that hasn't really happened," Kapur explained. (More:How a Little Indian Bean Impacts US Fracking)

Bollywood films are more than movies that are made in India. They typically incorporate song and dance into their narrative and span virtually all film genres. They're also formulaic, star-studded and often epic in length — but they're beloved by their audience (which is why roughly 800 of the films are made each year).

The first Hindi Cinema film came out in 1913 — and what we know as Bollywood has morphed several times to focus on different themes (including a gritty period), but if you're talking about the all-singing/all-dancing version we all think of today, it was the late 1980s when the family-centric romantic musicals took hold.

While it is possible to access some Bollywood films through cable providers — and the films do play on select U.S. cinema screens, the biggest market for Bollywood films outside India is China. Meanwhile, Indian domestic issues such as poverty and piracy could prevent the Hindi film industry from seeing substantial growth in the years to come.

Film piracy's impact

It's a market that has already proven frustrating for some of Hollywood's biggest studios. Time-Warner and Sony both attempted co-productions in the country, which failed miserably. Today, only three studios have notable co-production presences in the Bollywood market: Disney, News Corp's Fox Entertainment Group and Viacom.

A handful of independent studios are publicly traded. Both Eros International and Balaji Telefilms trade on India's Bombay Stock Exchange and National Stock Exchange.

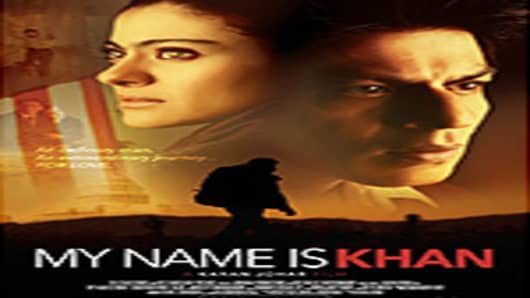

While Indian filmmakers \(and stars\) saw a window of opportunity when "Slumdog Millionaire" \(which, ironically, was not a Bollywood film\) hit theaters in 2008, they largely found the U.S. market a tough one to crack. While there have been occasional success stories, like 2010's "My Name is Khan," which grossed $37.8 million worldwide, most Bollywood studios have largely stopped trying.

"They discovered the heartland audience," said Aalif Surti, creative consultant at Fox Star Studios India. "Smaller cinemas started opening in smaller towns and the films stared catering to them once again — and that business exploded." (More:

That explosion could be short lived, though. There are roughly 16,000 theaters in India today — and the growth rate is slow. Megaplexes are becoming more common, which has led to a rise in ticket prices. Today, a ticket at a megaplex costs between $2.50 and $5 — cheap by U.S. standards, but in a country where the average per capita income hovers between $1,400 and $1,500 per year, that adds up quickly. (More:A Gluttonous Food Industry That Lacks Investors)

As a result, piracy is seeing dramatic increases.

"People get very excited about your film, but most of that excitement spills over into piracy," said Kapur. "Only 15 percent of the people who see a pirated version can afford to go to the theater. As multiplexes are rising, we're facing a unique situation: 80 percent of the people of India cannot afford to go to the multiplex."

That hasn't stopped the overall box office in India from expanding in recent years, something Kapur said he expects to slow soon. Domestic income makes up nearly 85 percent of Bollywood's box office take today — and that, he said, is leading to a problem. (More:10 Hot Indian Startups)

"We need an acceleration of growth, but in terms of how Indian films are going to be doing overseas, it's not going to be phenomenal growth," he said. "The biggest advantage Bollywood has is it was very responsive to local needs and local demands. Therefore, it can survive this onslaught of Hollywood coming in. That's also its biggest problem. If you can make a little money in your local market, there's not that urge to go out and find a larger audience."

Surti is a bit more optimistic, saying he believes things are much better than two years ago, when studios were throwing money around carelessly, overpaying for films that didn't succeed.

"Now you're seeing that prices have become more sensible," Surti said. "The box office has grown for some time now — and I expect it will continue to grow at least another four or five years."