For quite some time the Fed chairman has been viewed as a driving force behind the rally, but on Tuesday that may have changed – permanently.

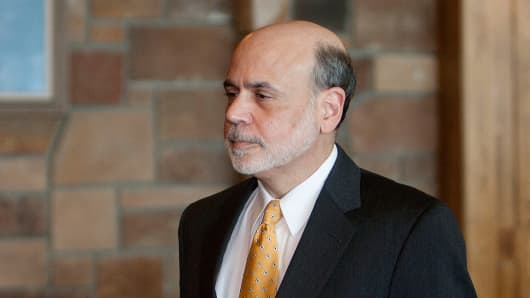

That's because a New York Times report said that Chairman Ben Bernanke has told close friends he probably will not stand for a third term at the central bank.

Officially, Bernanke has not commented publicly and his term doesn't end for well over a year - in 2014 – but nonetheless, the developments may be a game changer.

Under Bernanke, the Fed has implemented a string of unconventional efforts to stimulate the economy – known on Wall Street as QE, QE2 and QE3.

The Street even feels language used by Bernanke - specifically his use of the words 'wealth effect' - was intended to hint that he favored a robust stock market.

"Since 2009, monetary policy has trumped economics – pros always felt that Ben Bernanke had their backs," said top trader Brian Kelly, co-founder of Shelter Harbor Capital, on The Kudlow Report.

"Without Bernanke, liquidity in the market is called into question."

Although the market doesn't know who would replace Bernanke – whether they would be hawkish or dovish – they would certainly be different.

Considering the market is a predictive mechanism, Larry Kudlow believes the mere chatter of Bernanke's departure could change the market dynamic.

"This Bernanke news is probably bigger than its being made out to be," agreed Kelly.

Republican presidential nominee Mitt Romney has already said he would not re-nominate Bernanke if he wins the presidency.

Tune in:

"The Kudlow Report" airs weeknights at 7 p.m. ET.